Ron Allen’s induction into the Native American Hall of Fame marks a remarkable achievement — but it also exposes a double standard in Clallam County governance. While the Tribe’s $100 million annual budget nears that of the entire county, its growing land base continues to erode the local tax rolls. Meanwhile, county commissioners refuse to respond to federal impact inquiries or even ask for fairness from their “most important partner.”

A Well-Deserved Honor — and a Necessary Discussion

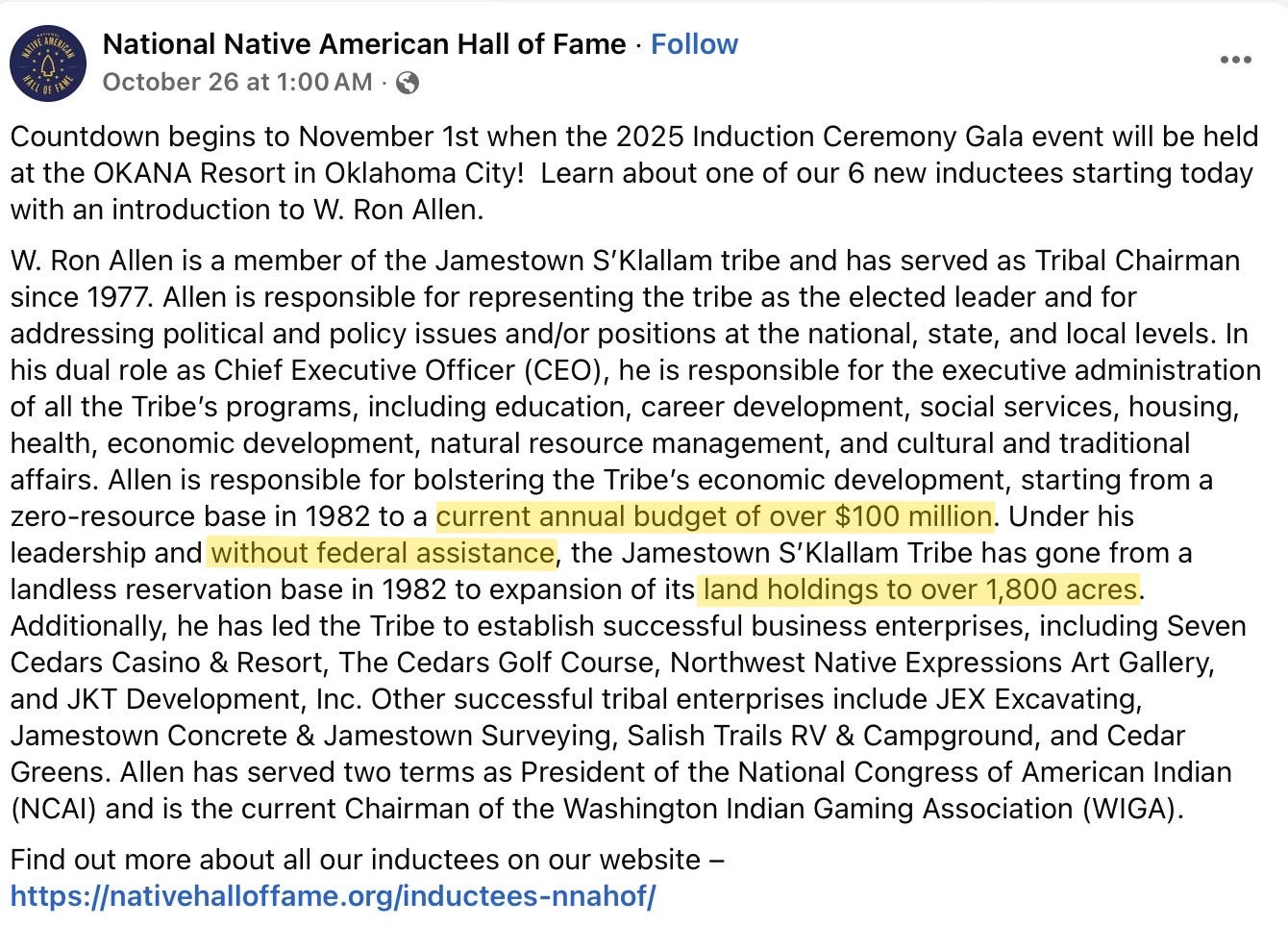

Ron Allen, longtime CEO and Tribal Chairman of the Jamestown S’Klallam Tribe, will be inducted into the Native American Hall of Fame this weekend — a fitting recognition for nearly five decades of leadership. Under his direction, the Tribe grew from a landless reservation to a prosperous, multifaceted enterprise with holdings exceeding 1,800 acres and an annual budget surpassing $100 million.

It’s an extraordinary success story — especially impressive considering Ron Allen has accomplished it “without federal assistance.”

But that last phrase, “without federal assistance,” deserves a closer look. In reality, the Tribe’s growth has relied heavily on federal grants, taxpayer-funded infrastructure, and programs administered by the Bureau of Indian Affairs (BIA) and the Department of the Interior. Those same taxpayers — the residents of Clallam County — are now carrying a growing share of the local tax burden as more properties are removed from county tax rolls and converted into tribal trust land.

Over $100 Million for 209 Members

To put the numbers in perspective: Clallam County’s total annual budget is $157.4 million and serves 77,480 residents. The Jamestown Tribe’s budget tops $100 million and serves just over 200 local tribal members.

Yet the Tribe’s extensive portfolio of businesses, including Seven Cedars Casino & Resort, Cedars at Dungeness Golf Course, and JKT Development, operates under a system of sovereign exemptions that shield them from many local taxes that competing businesses must pay.

Even more striking — the Tribe’s 100-room hotel is exempt from the lodging tax that every other hotel in the county is required to collect, a tax that funds tourism promotion, parks, and infrastructure.

Over two months ago, the Clallam County Commissioners sent a simple letter to the Jamestown Tribe requesting a conversation about contributing to both property and lodging taxes — a contribution estimated to be worth between $1.1 million and $3 million annually, and likely even higher. That letter has gone unanswered. Yet Commissioner Mark Ozias, who has described the Jamestown Tribe as “our most important partner in local governance,” seems unwilling to press the issue.

It raises a fair question: If an ordinary citizen ignored a county request about property taxes, how long before the county would take action to collect — or seize — that property?

“I believe that the Jamestown S’Klallam Tribe is our most important partner in local governance whether we’re talking about healthcare, or habitat restoration, or transportation, or emergency management, or economic development, or any of the myriad of areas that we work together for this community, and I hope to do better in meeting that standard in the future.” — Commissioner Mark Ozias

Silence from the County — and Complicity from Olympia

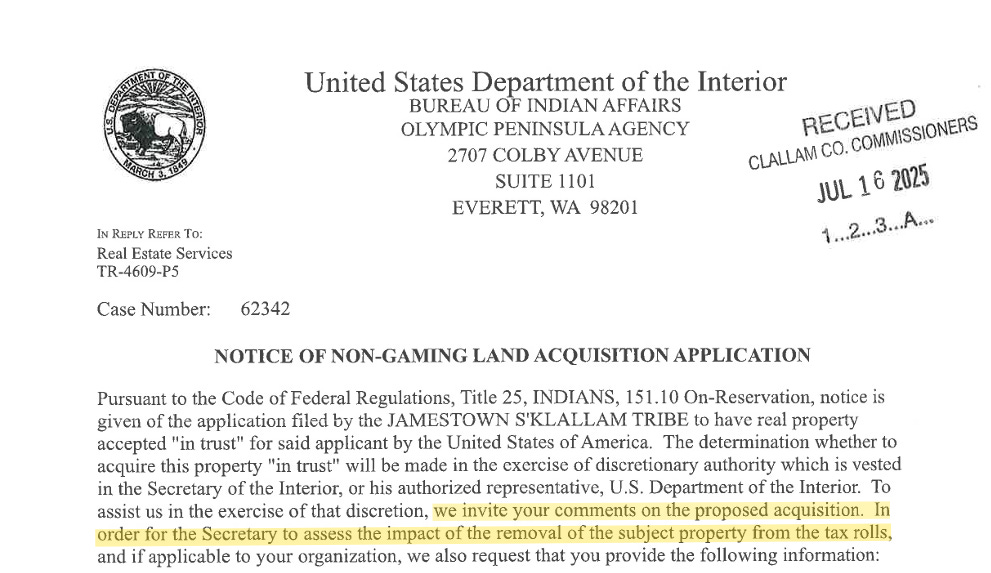

Every time the BIA considers a new conversion of land into tribal trust status, it is legally required to ask county commissioners how the change will affect local services, from schools and hospitals to fire districts and libraries.

In Clallam County, not a single commissioner has responded to those letters in at least a decade. When the county provides no response, federal law interprets that silence as approval — effectively a green light for each conversion, no questions asked.

Meanwhile, rather than standing up for taxpayers or even engaging with the BIA, our commissioners have asked voters to raise their own property taxes to make up for lost revenue. Think about that: elected officials would rather tax residents more than acknowledge that a shrinking tax base is damaging the county’s economy.

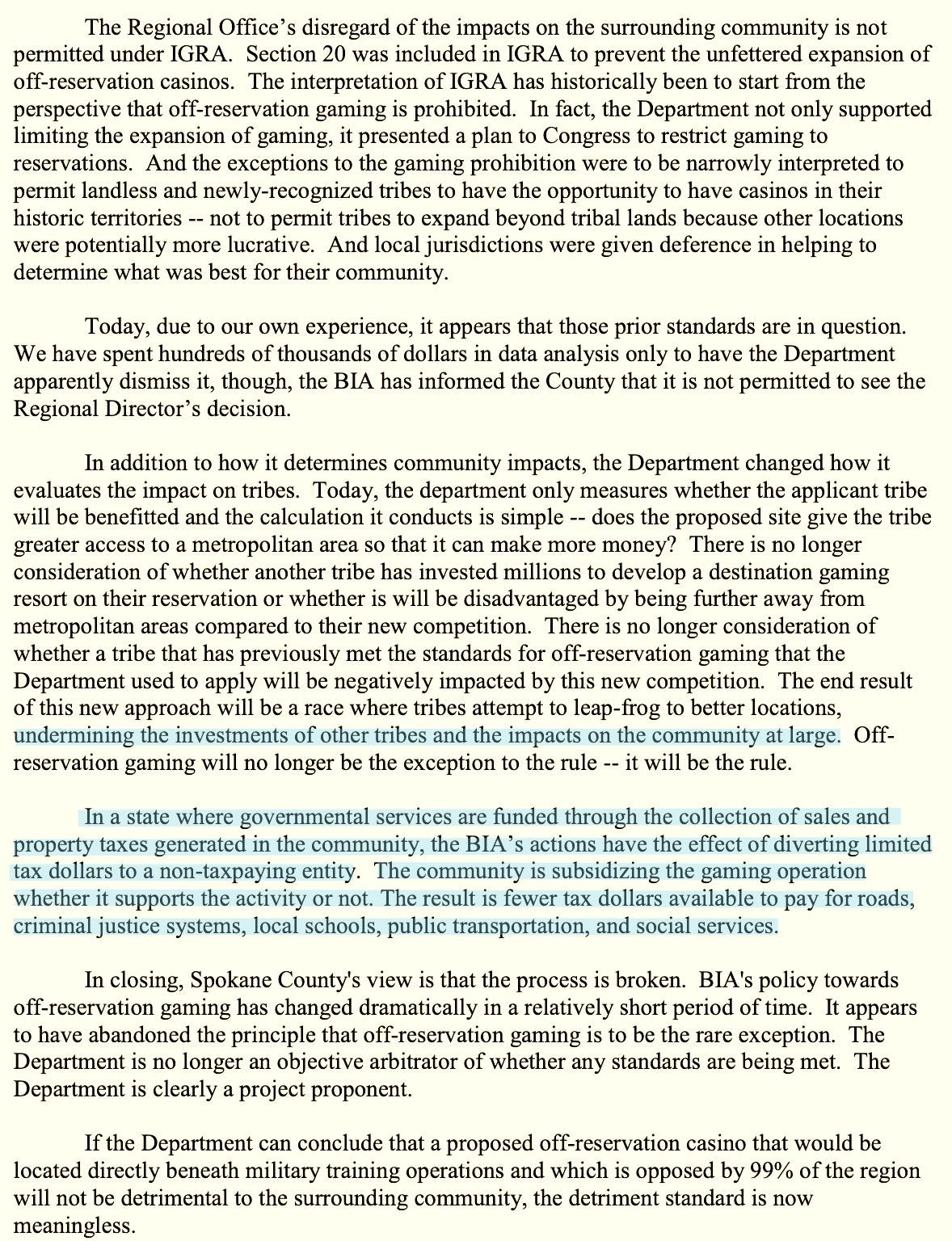

When Spokane Spoke Up

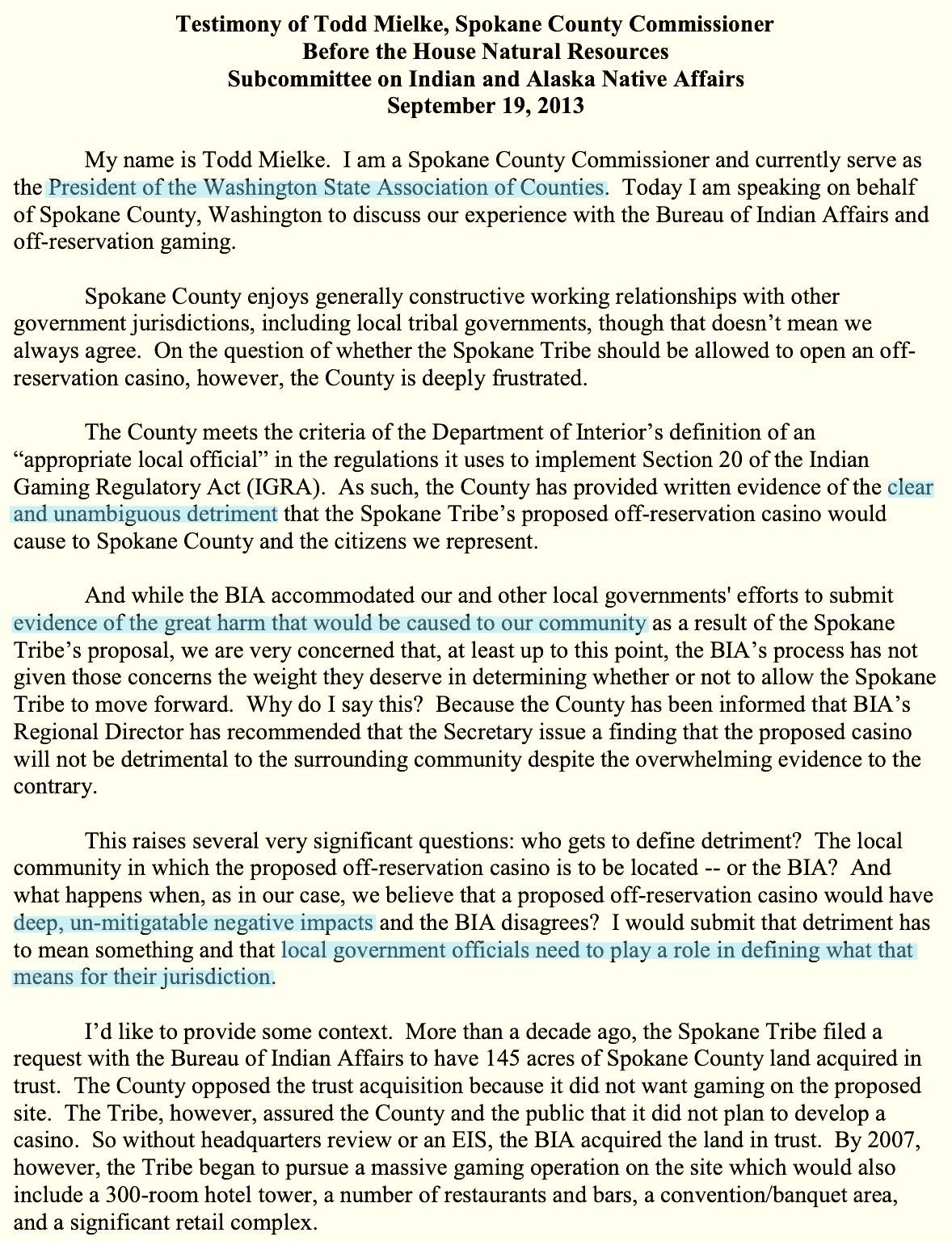

This isn’t about being “anti-tribe.” It’s about basic representation and accountability — principles that other counties have managed to uphold respectfully.

Current Clallam County Administrator Todd Mielke once did exactly that. As a Spokane County Commissioner, Mielke wrote to the federal government expressing concern about the economic impacts of tribal trust land conversions. His 2013 testimony before Congress didn’t attack heritage — it defended taxpayers, land use law, and regional stability.

He pointed out that off-reservation land acquisitions often undermine local economies and public infrastructure by diverting funds from schools, roads, and public safety. Spokane’s approach wasn’t racist; it was responsible and showed true leadership. Yet here in Clallam County, even raising those same questions has been labeled by some members of the Charter Review Commission as “anti-tribe,” “racist,” or attacking heritage.

The Tax-Hike Pipeline

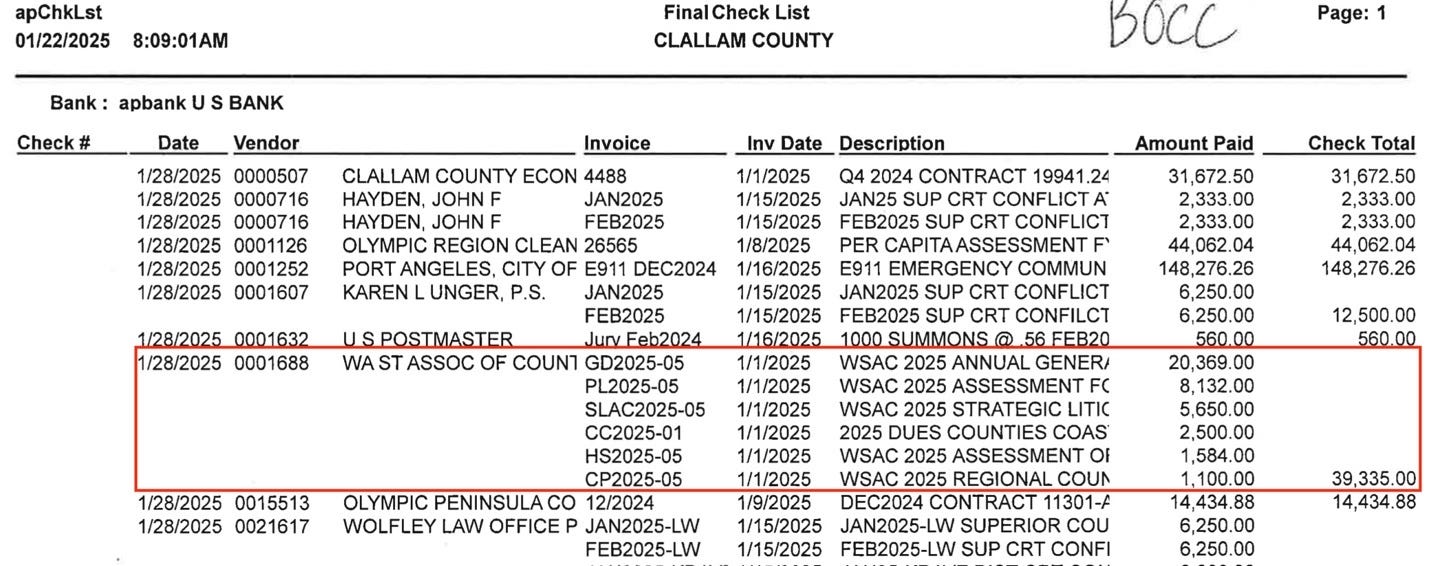

Ironically, Mielke now oversees Clallam County’s administration — the same county that pays nearly $40,000 a year in membership dues to the Washington State Association of Counties (WSAC), where Commissioner Ozias currently serves as Vice President. Mielke himself was WSAC’s President when he sent that letter 12 years ago.

WSAC’s top legislative goal for 2025–26? Raising property taxes without a vote of the people.

That includes lifting the 1% cap on annual property-tax increases to 3%, expanding county road levies, and adding a new mileage fee for drivers.

So while Clallam County pleads poverty, pays a lobbying group to advocate for higher taxes, and praises the Tribe as its “most important partner,” it continues to ignore federal requests for fiscal impact reports and remains silent as more taxable land is transferred out of local control.

A Moment to Celebrate — and Reflect

Ron Allen’s induction into the Native American Hall of Fame is unquestionably a milestone achievement and a testament to his leadership. But it also highlights a painful local truth: Clallam County’s leaders are celebrating partnerships they no longer have the courage to question.

True partnership isn’t built on silence or one-way benefits. It’s built on mutual respect — and mutual responsibility.

Until Clallam County’s elected officials find the courage to respond, communicate, and represent the taxpayers who elected them, the word “partnership” will continue to ring hollow.

We’re curious where readers of this publication fall on the political spectrum.