When citizens asked whether a powerful corporation should contribute fairly to county services, they expected their elected officials to advocate on their behalf—not quietly side with the donor who called them “complainers.” Newly obtained public records reveal how Commissioner Mark Ozias responded when Jamestown Corporation CEO Ron Allen dismissed tax concerns, demanded critics be “set straight,” and argued that voluntary contributions should substitute for mandatory taxes. The emails expose a deeper problem: Clallam County has lost representation, and a leader of a sovereign nation is instructing a county commissioner how to handle his own constituents.

In the podcast: If we are racists, why isn’t Ron homophobic? Guess which sovereign nation voluntarily sold its landbase. The two unsung heroes of Clallam County government. And Mitch Zenobi’s public comment is a must-hear.

A Citizen Who Wouldn’t Let It Go

Sequim resident Karen Parker is persistent for a reason. For months, she has tracked the Clallam County Commissioners’ promise to “have a conversation” with the Jamestown S’Klallam Tribe about the growing number of properties being removed from the county tax rolls through trust conversion.

The issue is straightforward. When property leaves the tax rolls, the county does not lose revenue—it redistributes it. The same amount is collected from fewer taxpayers, meaning everyone else pays more.

The commissioners acknowledged this reality themselves in internal communications. As Commissioner Ozias explained to Ron Allen, when property is removed from the rolls, “those dollars…are simply re-distributed among all other property tax payers.”

Yet despite acknowledging this burden, the commissioners’ follow-through was minimal.

The Letter That Said the Quiet Part Out Loud

The much-discussed letter—first floated in January, then finally sent in August—was not simply a request for discussion. It included a clear statement that Commissioners Ozias, French, and Johnson “support the Jamestown S’Klallam Tribe’s work to create a landbase.”

That admission matters.

County land has been repeatedly sold or transferred in ways that reduce the local tax base. The commissioners are not neutral observers of that outcome—they have declared support for it. The result is a shrinking county tax base paired with growing service demands, paid for by residents and businesses that cannot opt out.

What the Public Was Told—And What the Records Show

At a December 30 Commissioners’ Forum, Karen Parker again asked whether the county had followed up with Jamestown after the August letter.

Commissioner Ozias assured her publicly that he had “communicated twice” with Chairman Ron Allen and reaffirmed interest in meeting.

So Parker did what engaged citizens are supposed to do: she verified the claim.

The public records she received tell a different story.

Every documented attempt by Commissioner Ozias to engage Ron Allen occurred before the August 26 letter was finalized and sent. There is no record of follow-up outreach after that point.

“Set Him Straight”: How Taxpayers Were Characterized

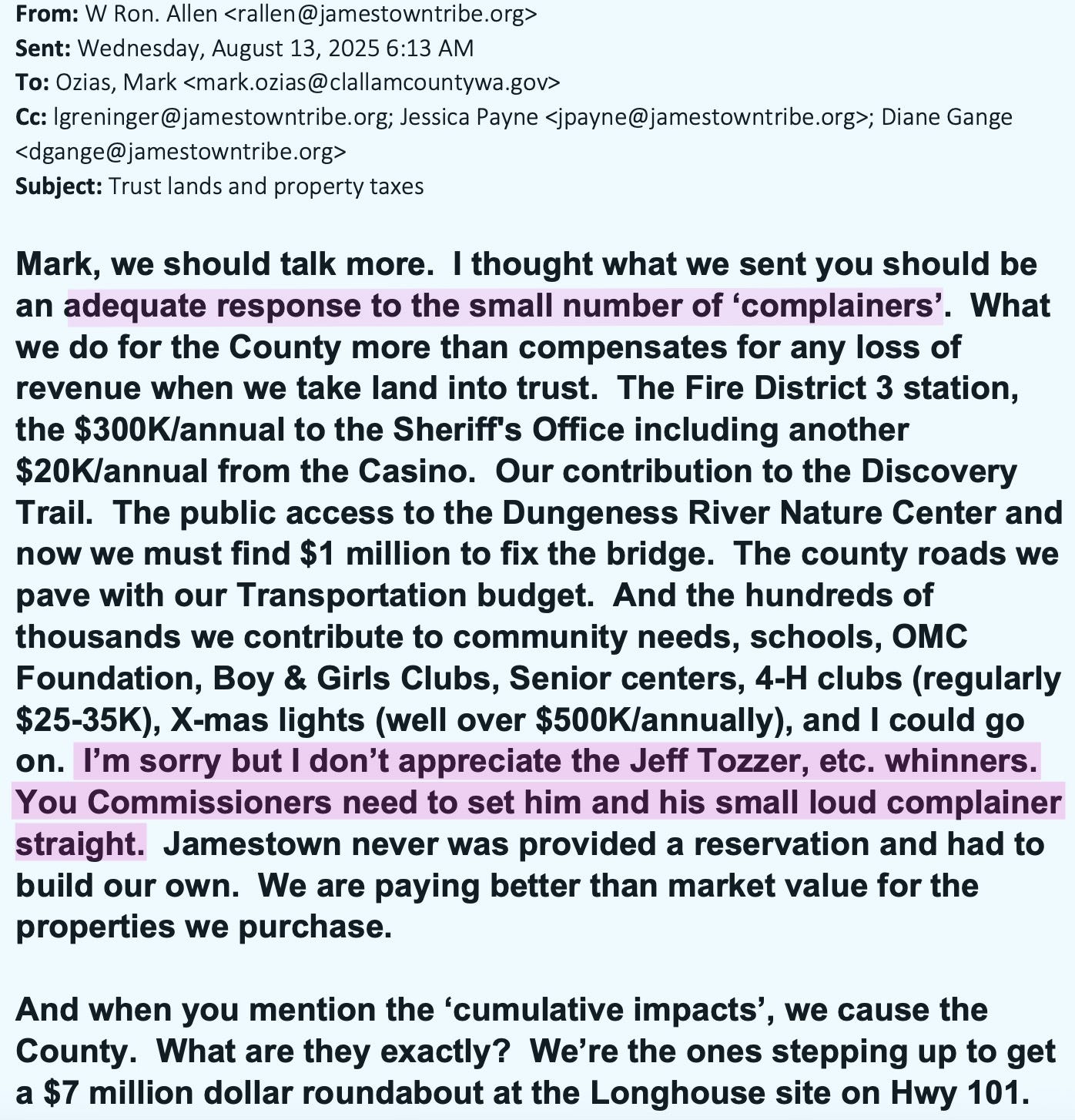

In response to the county’s inquiry about tax impacts, Ron Allen dismissed concerns as coming from “a small number of ‘complainers’” and escalated from there:

“I don’t appreciate the Jeff Tozzer, etc. whinners. You Commissioners need to set him and his small loud complainer straight.”

This was not said in public. It was said privately, to elected officials, about the very residents they represent.

What matters just as much is what came next.

The Silence That Spoke Loudest

Commissioner Ozias did not defend his constituents.

He did not explain that citizens questioning tax policy are not “whiners.”

He did not point out that fixed-income residents and small businesses absorb higher tax bills when land leaves the rolls.

He did not push back on the idea that accountability equals hostility.

Instead, Commissioner Ozias pivoted to discussing how the Tribe’s investments could be “described” more effectively to county residents—essentially brainstorming a better communications strategy for Jamestown, not advocating for taxpayers.

That response matters. Silence, in this context, is not neutrality. It is alignment.

Transparency Claimed—But Not Practiced

Just over a month ago, the Jamestown S’Klallam Tribe submitted a formal letter to the Charter Review Commission, weighing in on proposed changes that would require Clallam County Commissioners to respond formally when land is converted into tribal trust.

The Tribe opposed that requirement.

In the letter, Jamestown stated:

“We believe that we have been very transparent in our goals and objectives.”

That assertion deserves scrutiny.

Transparency does not occur through private emails calling taxpayers “whiners.”

It does not occur when elected officials are urged, behind closed doors, to “set” constituents “straight.” And it does not occur when discussions about taking over publicly owned assets—such as the Dungeness Recreation Area county park—are floated quietly rather than debated openly.

True transparency requires public process, on-the-record discussion, and direct engagement with the people affected by the outcome. By opposing even a requirement that commissioners formally respond to federal trust conversions, the Tribe’s stated commitment to transparency stands in sharp contrast to its actions.

What is being rejected is not bureaucracy—it is sunlight.

Voluntary Contributions vs. Mandatory Taxes

Ron Allen’s defense rests on a familiar argument: Jamestown gives generously, so taxes are unnecessary.

But generosity is not the same as obligation.

Property taxes are mandatory, predictable, and enforceable. They fund courts, jails, roads, public health, and basic governance—regardless of who holds office or which priorities change.

Voluntary contributions are none of those things.

If federal funding disappears, Jamestown is not obligated to replace it. If leadership changes, donations can stop. If budgets tighten, charity is optional. Taxes are not.

This distinction is not ideological. It is structural.

Examining the Claimed “Benefits”

Allen listed numerous contributions as justification for tax exemptions. Each deserves scrutiny.

Sheriff’s Department Funding

Jamestown cites roughly $300,000 annually for sheriff services. What is rarely mentioned is that this funding flows through federal contracts—meaning taxpayers already pay for it. When Jamestown “gives” that money to the county, it is returning federal dollars sourced from taxpayers in the first place. If the federal government cancels the contract, Jamestown has no obligation to continue funding.

Fire Station and Infrastructure

Fire stations, roads, and emergency services are core public functions. Private developers routinely pay impact fees, mitigation costs, and taxes that support the same infrastructure—without press releases or praise.

Discovery Trail and Public Access

Businesses, nonprofits, and private landowners across Clallam County contribute easements, fees, and donations to public access projects. They do so while still paying property taxes.

Payroll and Sales Tax

Employment and sales tax are not substitutes for property tax. Every large employer contributes to the economy. That does not exempt them from paying into the systems that support courts, jails, elections, and land-use enforcement. Additionally, other businesses operate under Washington State law which mandate paid maternity leave, the Jamestown Corporation does not.

Advocacy for Some, “Whining” for Others

In the January 2026 Jamestown tribal newsletter, Chairman Ron Allen reflects on what he describes as a difficult year navigating the federal government. He cites challenges tied to “Indian programs,” uncertainty caused by DOGE-related federal disruptions, the loss of senior staff within agencies, halted grants, and extensive program reviews.

He specifically notes concern over a $3.9 million federal IRA grant intended to replace a fishery lab that floods each winter, stating it is now struggling to be reapproved.

That is advocacy—fairly and appropriately so.

But when Clallam County residents raise concerns about tax fairness, representation, and the shifting burden caused by trust land conversions, those same efforts are dismissed privately as “whining” and “complaining.”

The contrast is stark.

Everyone involved wants the same thing: Fair representation, transparent government, and a system where corporations contribute equitably.

What differs is whose advocacy is respected—and whose is ridiculed.

A Path Forward That Honors the Public

There is a solution.

If Jamestown believes its contributions truly offset the tax burden shifted onto residents, that case should be made in public.

The county should hold an open work session, on the record, where Jamestown representatives and county commissioners can openly discuss:

the cumulative tax impacts of trust conversions

what services are being funded voluntarily

what obligations disappear if federal funding ends

and whether a formal, enforceable agreement is warranted

Not behind closed doors.

Not on sovereign land.

Not through private emails disparaging constituents.

Transparency is the only way forward.

Call to Action: Representation Requires Engagement

Clallam County residents did not elect a tribal chairman to manage their concerns.

If you believe the county has lost its voice—and that representation now flows in the wrong direction—contact the three leaders responsible for county governance:

Randy Johnson, Commissioner Randy.Johnson@clallamcountywa.gov

Mike French, Commissioner Mike.French@clallamcountywa.gov

Ron Allen, Chairman & CEO, Jamestown S’Klallam Tribe rallen@jamestowntribe.org

Ask for a public work session.

Ask for transparency.

Ask why a sovereign leader is telling a county commissioner how to treat constituents.

Because representation is not whining.

And accountability is not hostility.

It is the job.

In the podcast, I mentioned that I would be attending the Clallam Bay/Sekiu Advisory Meeting. However, that meeting has been postponed. I will instead see you at Barhop Brewing in Port Angeles at 5:00 p.m. tonight for a community meetup hosted by Mimi Smith.