Guest contributor Jake Seegers explains how some people give, while others take—and Clallam County’s commissioners have made a career of taking. This November, they’re asking voters for another $3.25 million in a “levy lid lift,” claiming the 1% tax cap has tied their hands. But the numbers tell a different story: county spending is up 52%, grant revenues have more than doubled, and taxes have already outpaced inflation. From parcel fees to cultural access taxes, from permit hikes to school levy endorsements, this is a six-year pattern of government growth—one “small” increase at a time.

By Jake Seegers, guest contributor

Most people fall into one of two categories: “givers” or “takers.” We all know the type who only call when they need something. Others thrive on giving.

When it comes to taxpayer money, Clallam County Commissioners wear only one hat: takers. And the citizens footing the bill are buckling under the weight.

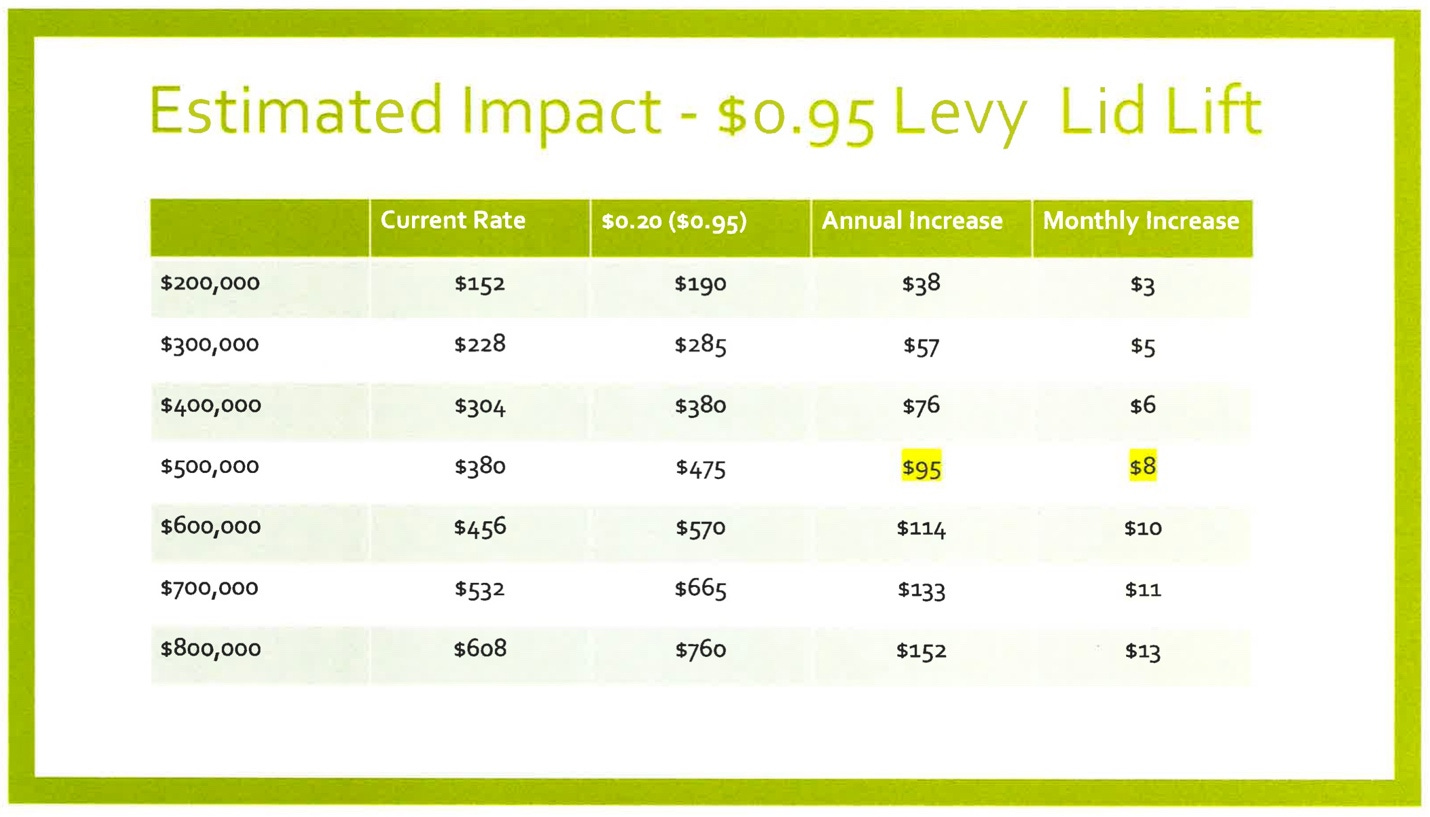

On this November’s ballot, commissioners want to keep taking. They’re asking for a levy lid lift from $0.7598 to $0.95 per $1,000 of assessed property value—a $3.25 million annual tax hike for the county’s general fund.

This time, voters—not commissioners—will decide. Unlike the Clallam Conservation District’s $5 parcel fee, which passed despite 1,032 signatures in opposition, the levy lid lift is going on the ballot and will be mailed out in less than two weeks.

Commissioners claim the lift is necessary because tax revenue is capped at 1% growth, but the data says otherwise:

From 2018 to 2024, the Bellevue Consumer Price Index (CPI) rose 30.4%. Clallam County uses Bellevue’s CPI as its benchmark because it is the nearest geographical measure reported by the U.S. Bureau of Labor Statistics.

County tax revenues, which are sourced from property and sales taxes, increased 39.3%

County property taxes rose 17% (2.7% annually)

County expenses ballooned 51.6% during these six years.

Federal & state grant revenue skyrocketed 125.7% during the same period.

(Source: WA State Auditor’s FIT Tool)

The data tells the story: county government is spending beyond its means and outpacing inflation. Behind this trend are commissioners who rarely hear of a tax they don’t like. Here are the top ten examples.

1. Culture & Arts Sales Tax

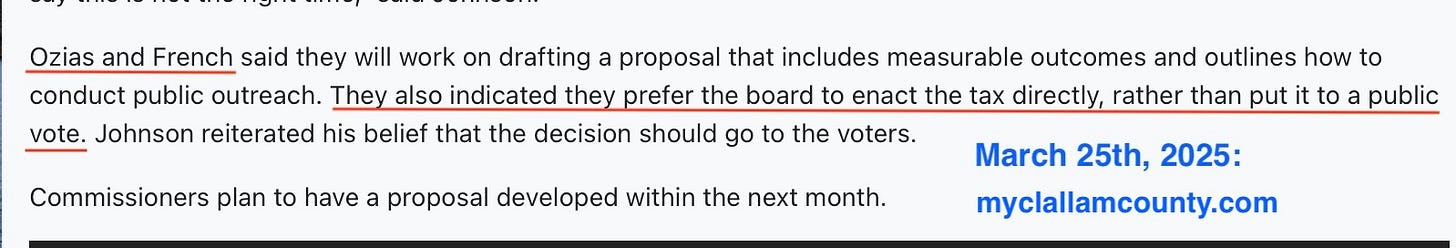

In late 2024, the commissioners floated a 0.1% cultural access sales tax to subsidize arts and heritage programs. Commissioners Ozias and French both support the tax.

On September 17, 2024, the Peninsula Daily News reported that Commissioner French believed that the tax could provide “sustainable funding” and allow organizations to be less reliant on private donors.

“A reliance on philanthropy can be risky for nonprofits,” French said, “because it can create a situation where those organizations begin to spend their time chasing public dollars. Additionally, private donations don’t have a democratic component that allows the public to choose which programs they want to fund.”

Yet, in a KONP Radio interview, Commissioners French and Ozias suggested that they may bypass a public vote on the cultural access tax and instead enact it directly by a commissioner majority.

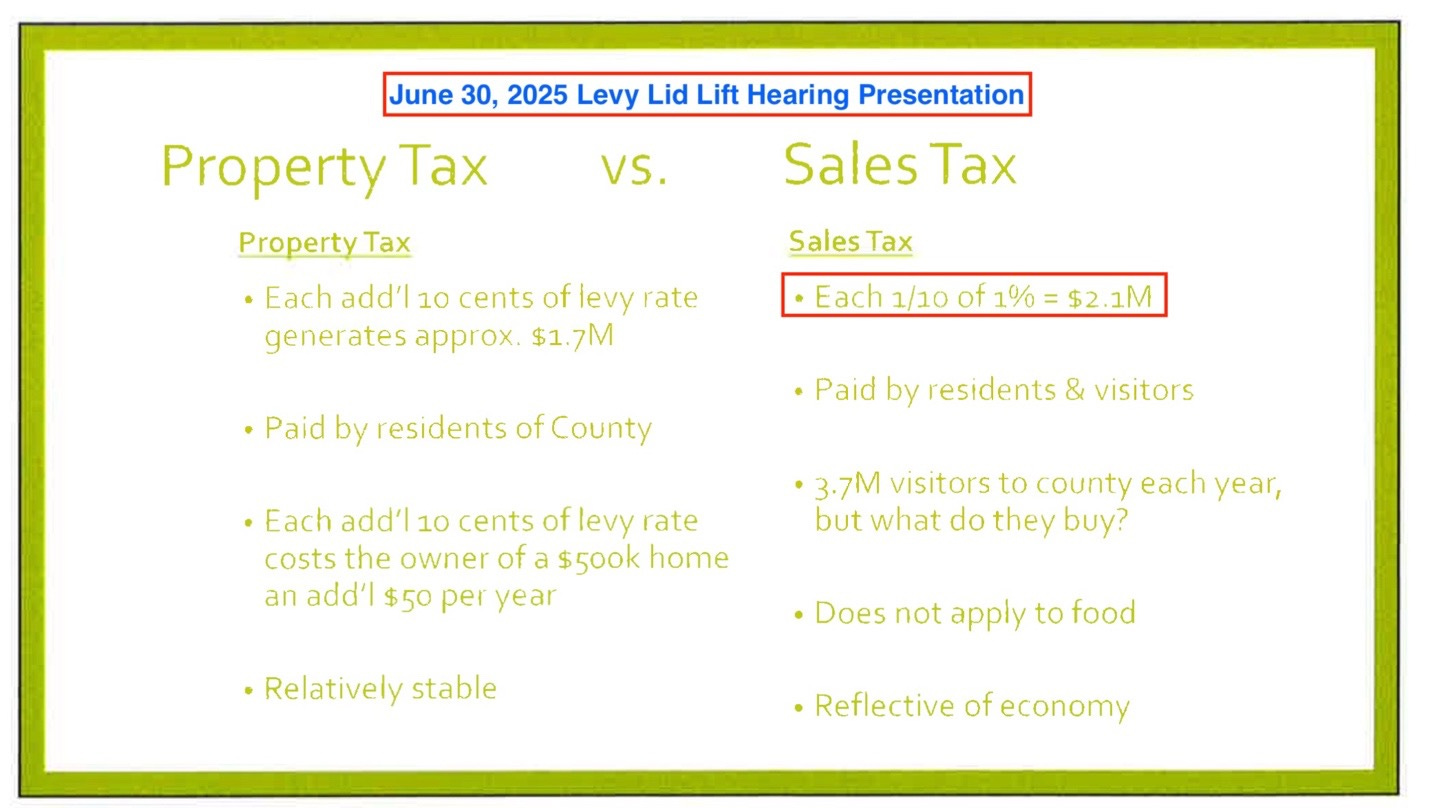

According to County Administrator Mielke’s presentation at the July Levy Lid Lift hearing, every 0.1% increase in sales tax generates roughly $2.1 million annually. That represents an enormous “take”—especially if imposed by the commissioners without voter approval.

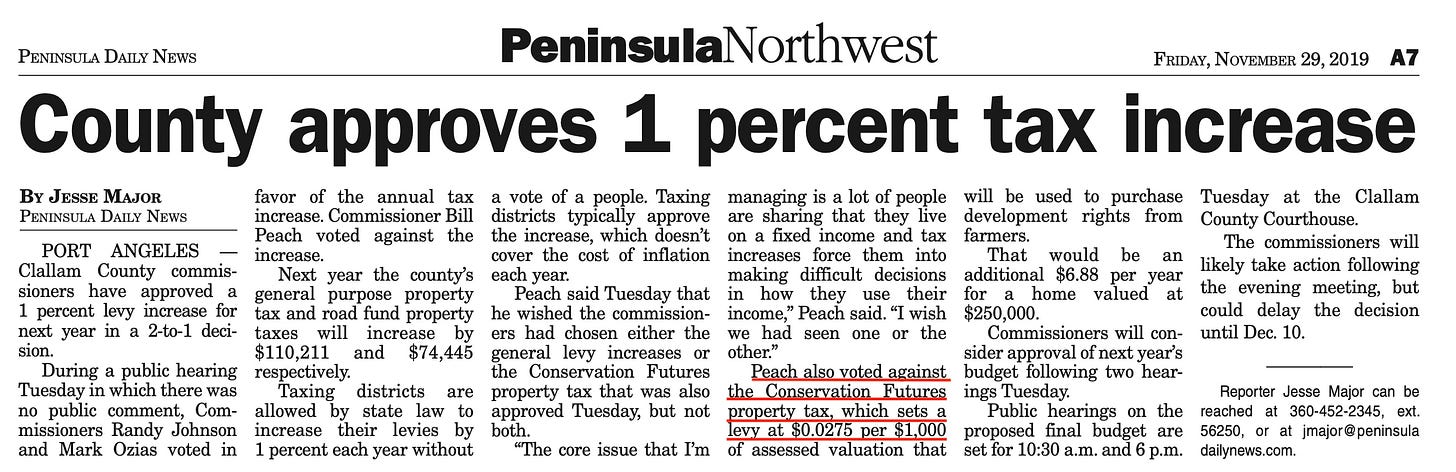

2. Conservation Futures Levy (2019)

In December 2019, Commissioners Johnson and Ozias voted 2–1 to impose a new property tax of $0.0275 per $1,000 of assessed value to fund land acquisitions, as reported by the Peninsula Daily News. Commissioner Bill Peach voted against it.

Since 2020, the Conservation Futures tax has collected nearly $1.7 million from county taxpayers, according to assessor records. Once again, a new tax was imposed without a public vote.

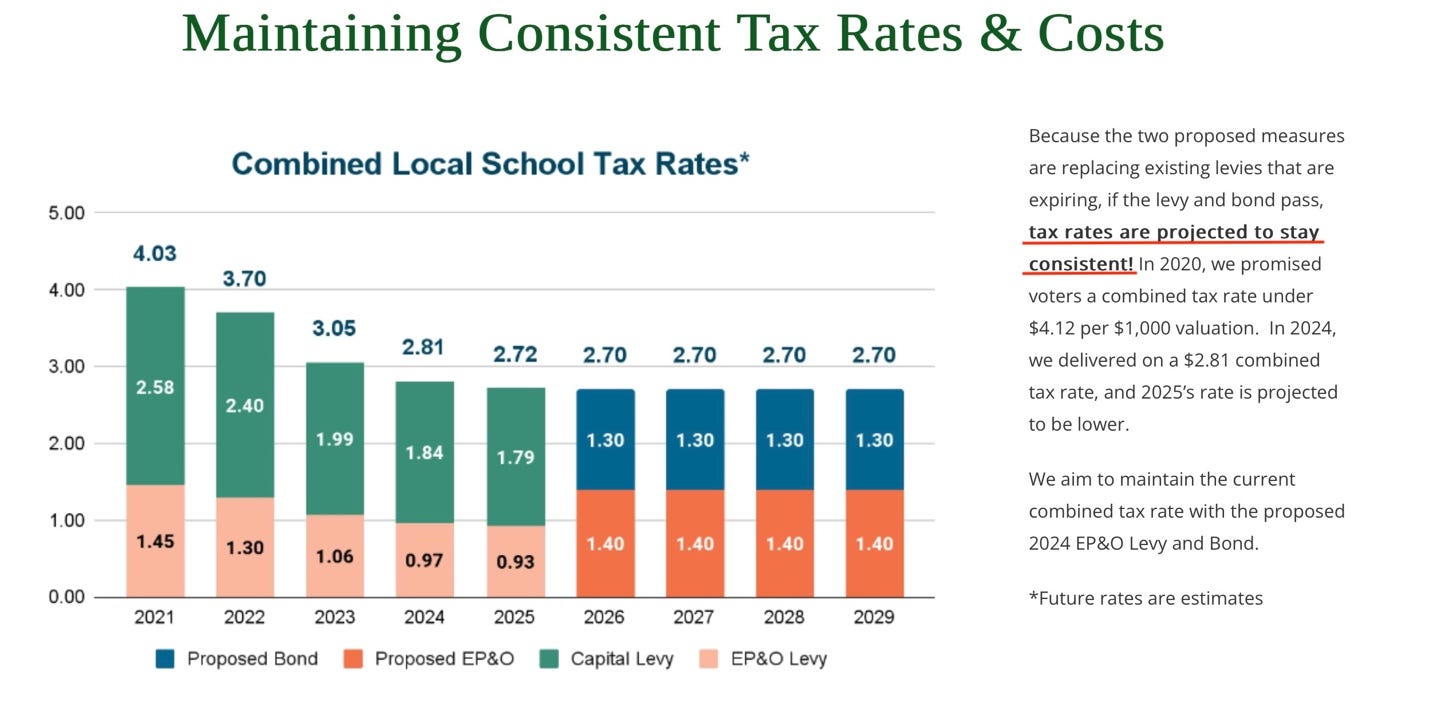

3. Sequim School Levies — $182 Million Endorsed

In December 2024, commissioners passed two resolutions supporting Sequim School District ballot measures: a $36.2 million EP&O levy and a $145.95 million bond. These endorsements gave political cover to higher property taxes, even though commissioners don’t directly set school levies.

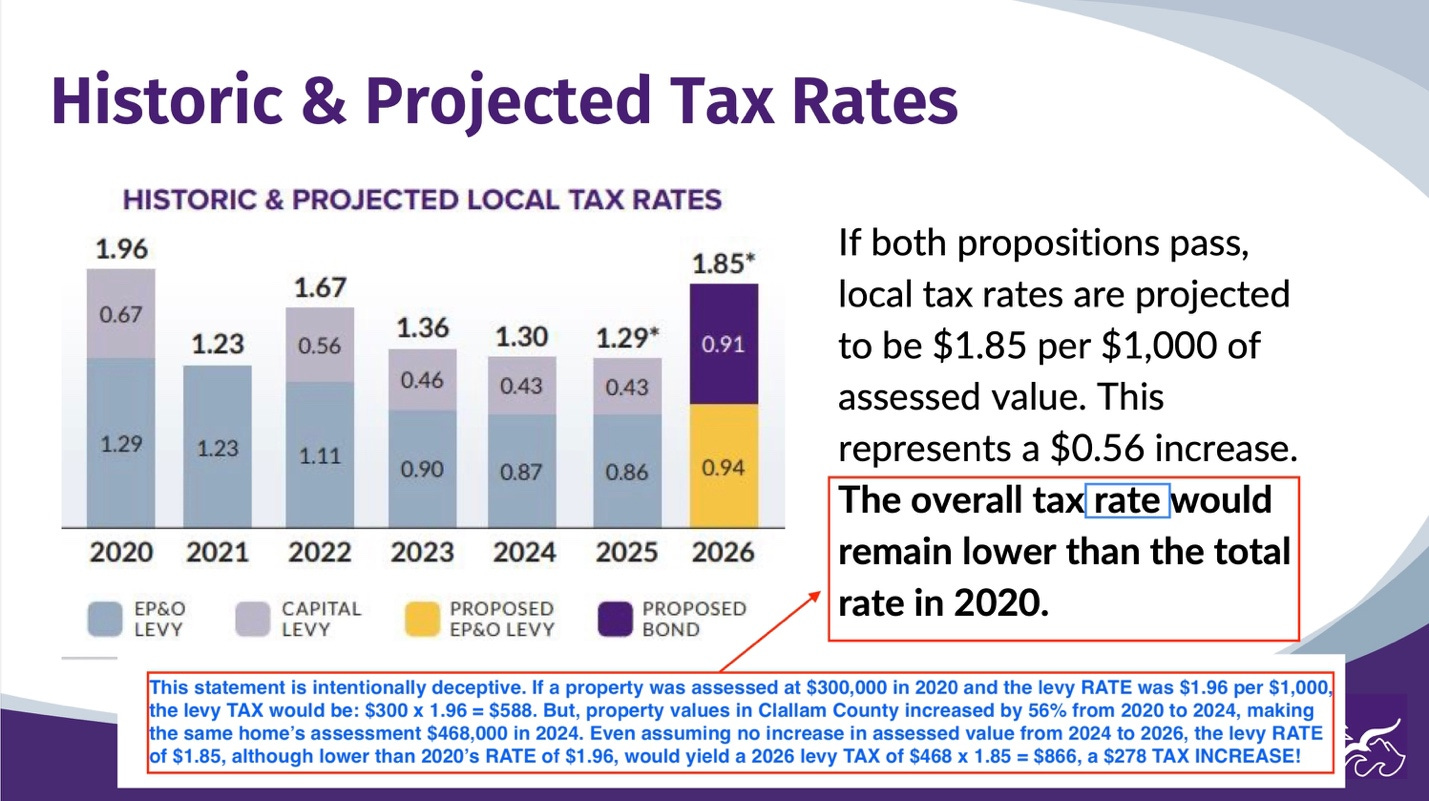

The district marketed the proposals by stressing that levy rates were lower than in 2020.

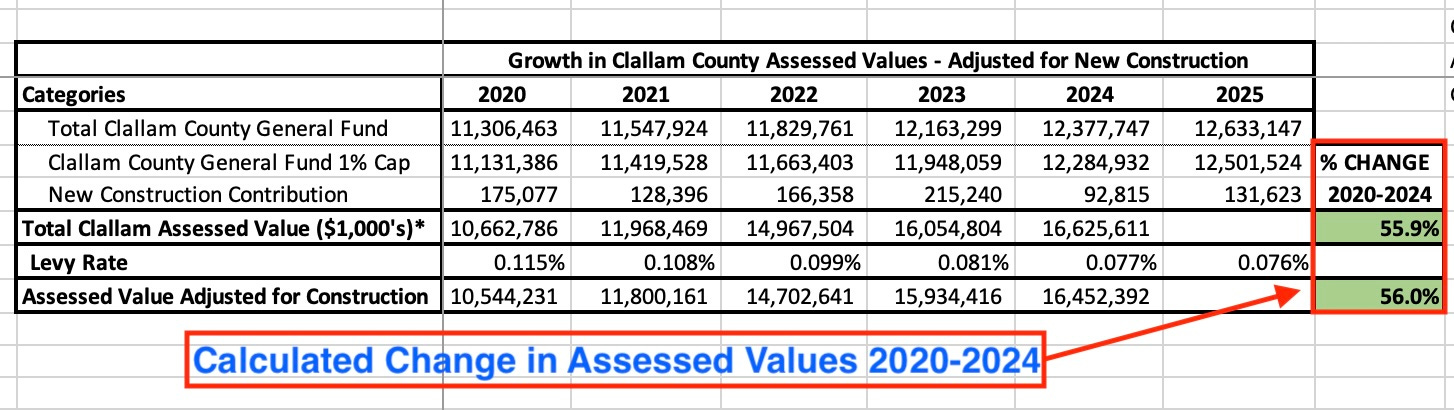

But because property values had risen by 56% since then, the actual tax bills would climb sharply. A $300,000 home in 2020 that paid $588 under the old levy would owe $866 in 2026 on the same property—a $278 tax increase—despite the “lower rate.”

Commissioners sided with the school district instead of demanding clarity for voters.

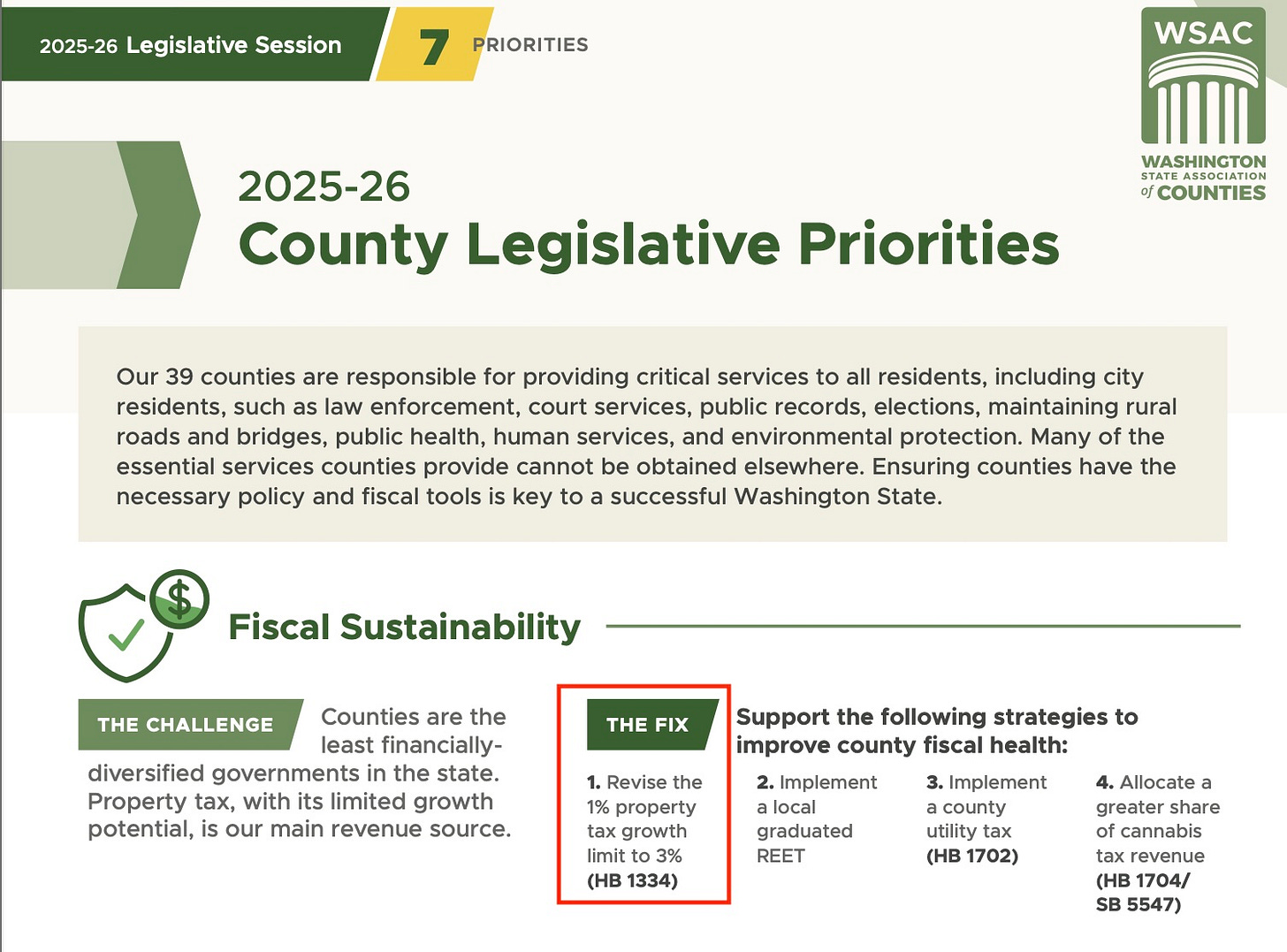

4. Raising the 1% Lid — HB 1334

Washington law caps property tax growth at 1% annually unless a vote of the people approves it. HB 1334, pushed by the Washington State Association of Counties (WSAC), would raise the cap to 3% or tie it to inflation.

Commissioner Mark Ozias, who also serves as First Vice President of the lobbying group WSAC, backed HB 1334—a bill his own organization made a top legislative priority. As Commissioner Ozias told the Peninsula Daily News:

“I expect that cap-increase effort will come back into play, and that new revenue tools are likely to show up in our upcoming budgets.”

In other words, Commissioner Ozias isn’t just backing higher taxes locally—he’s working to reshape state law so commissioners never have to ask voters again.

5. OMC Levy Lift Support

On July 16, 2024, commissioners unanimously endorsed Olympic Medical Center’s Proposition 1 levy lift. The measure increased OMC’s property tax revenue from $4.8 million in 2024 to $11.8 million in 2025—a $7 million annual increase approved by voters.

Commissioners were quick to lend their support, even as local taxpayers continue to shoulder rising healthcare costs alongside higher property taxes.

Thus far, this $7 million annual tax hike has done little to solve OMC’s financial woes, and the hospital projects a loss of $16 million this year.

6. More School Levies

Commissioners have a long track record of backing school district levies. In 2018, Commissioners Johnson, Ozias, and then-Commissioner Peach endorsed Port Angeles School District Proposition 1, which raised school taxes to $2.47 per $1,000, according to Peninsula Daily News.

Mike French, then a member of the Port Angeles City Council, also voted to support it, saying:

“There’s always a reason to say this isn’t the right time, but we have to start building schools now.”

It’s hard to find an instance where commissioners—or Mike French before he joined them—opposed a levy.

The Port Angeles School District utilized the same tried-and-true tactics: highlighting the rate to create the illusion that taxation is stable or dropping. Commissioners reinforced the sales pitch and used it as an opportunity to advance their ideology of continual government expansion.

7. Mileage Tax Advocacy

State mandates promoting electric vehicles should have prompted lawmakers to reconsider Washington’s burdensome gas tax—already the highest in the nation. Instead, Commissioner Ozias’ WSAC, the Olympia-based lobbying group he helps lead, is looking for new ways to keep drivers paying—this time through a proposed pay-per-mile tax.

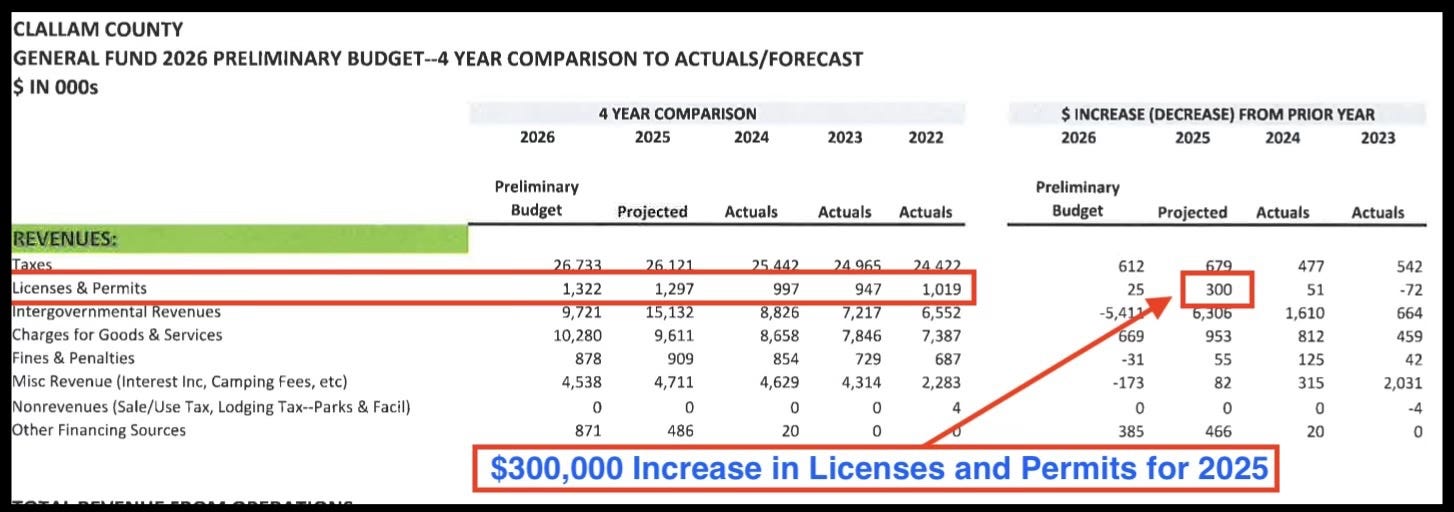

8. Permit and Fee Increases

As part of last year’s “7% exercise” in preparation for the 2025 budget, DCD Director Bruce Emery proposed raising permit and land division fees. During a July 29 budget meeting, Commissioner French supported the hikes, saying:

“The building community would prefer reliability… and they are less sensitive to cost.”

The hikes boosted license and permit revenues by $300,000 in 2025, climbing from a stable $1 million baseline in prior years. While fees appear to target contractors, they are ultimately passed on to homeowners and residents who pay the bills.

The ability of Clallam residents to afford a home continues to erode. In 2018, the county’s median home price was $293,000; by 2024/2025, it had increased to around $525,000—a 79% increase. Over the same period, median household income in Clallam County rose only 29%, according to Federal Reserve Economic Data. Rising permitting fees compound these pressures, further straining affordability for working families.

9. $5 CCD Parcel Fee — Ignoring 1,032 Voices

Last month, Commissioners Johnson and Ozias approved a $5 annual parcel fee for the Clallam Conservation District. Commissioner Mike French opposed it, but was outvoted. The fee passed despite the unprecedented delivery of 1,032 signatures in opposition at the public hearing.

This fee will extract $2 million from taxpayers over the next 10 years. That’s in addition to the $625,000 that Commissioners Johnson and Ozias had already funneled to CCD from the county’s general fund between 2020 and 2024.

10. The November 2025 Levy Lid Lift

Now, commissioners want to raise the levy rate from $0.7598 to $0.95, which would result in an additional $3.25 million annually from property owners. The pitch is always “just a cup of coffee” or “only $8 a month.” The commissioners have shown that they will always grow government “a little more.”

But after adding up their track record—the parcel fee, sales tax proposals, levy endorsements, conservation futures, and fee hikes—these “little mores” amount to millions.

At a recent CCD petition signing event, a kind woman with a walker approached the booth, wearing an “Elwha River Valley Restoration” hat. She asked what the petition was about and listened carefully as CCD’s role was explained. Even though she understood that CCD’s work aligned with her own restoration values, she reached for the clipboard and said with a smile, “I’m going to sign your petition anyway. I don’t have five bucks.”

How will she feel about $3.25 million...?

A Vote That Matters

Ballots hit the mail on October 15, and Election Day is Tuesday, November 4. That’s less than three weeks to study the facts, talk with your neighbors, and decide whether Clallam County can afford yet another tax hike.

Share this article with friends and family—especially those who may not know:

County spending has grown 51.6% in just six years.

Grant revenues are up 125%, showing there’s no shortage of outside funding.

Property taxes have already climbed 17%, even before this new proposal.

The truth is, not everyone can shoulder another increase. Many in our economically struggling county are already doing all they can to stay in their homes. Even if you can absorb the cost, please remember those who cannot. Property taxes don’t stop at homeowners—they’re passed down to renters and ripple through the local economy, deepening our housing affordability crisis.

No civilization in history has ever taxed its way to prosperity. Clallam County won’t be the first. Let’s ease the burden on those living at the margins, protect the stability of our neighborhoods, and send a message that fiscal discipline still matters.

When your ballot arrives, vote to protect affordability, accountability, and common sense.

Last Sunday, readers were asked how concerned they were about authoritarian behavior in Clallam County politics. Of 287 votes:

93% are very concerned

6% are somewhat concerned

1% are not at all concerned