As the cost of living in Washington State skyrockets, Clallam County residents are being hit from all sides—rising fuel costs, school levies, a recent hospital levy, and now new tax hikes disguised as essential service funding. But behind the curtain is a pattern of reckless local spending, bloated projects, and political misdirection. Pull back the curtain on where your tax dollars are really going—and what’s coming next if no one speaks up.

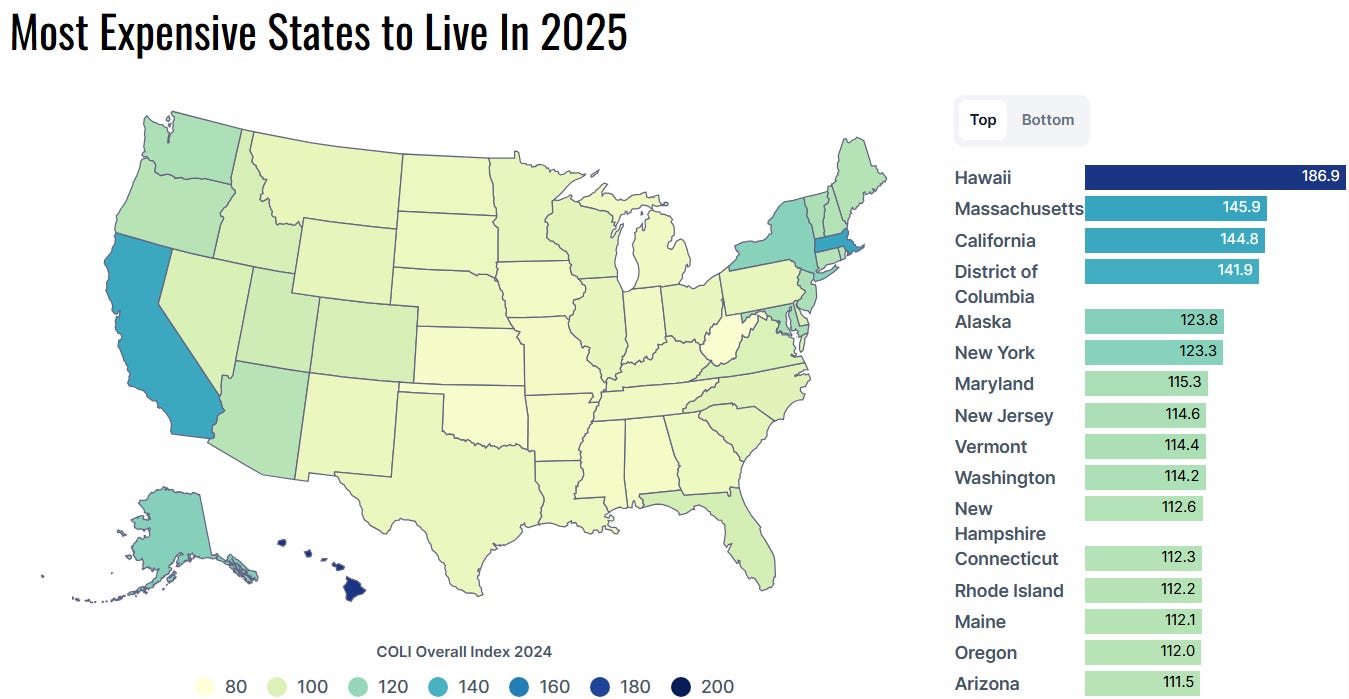

Washington State is already one of the most expensive places to live in the country. According to World Population Review, we rank 10th overall for cost of living.

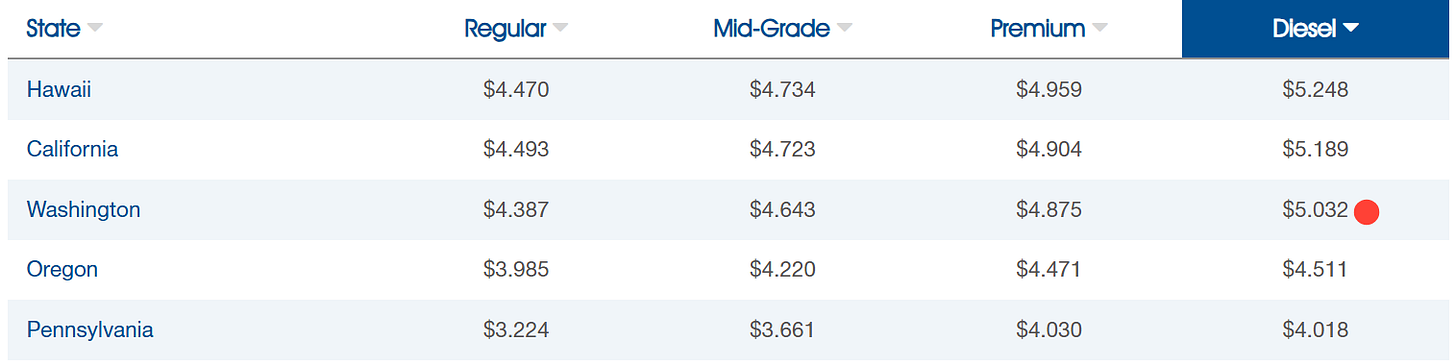

That’s not just because of housing or groceries—it’s policy-driven. The Capital Gains Tax, the Long-Term Care Tax, and the Climate Commitment Act (CCA) have all added costs to our daily lives, even if quietly. The CCA, in particular, acts like a shadow tax, driving up the cost of fuel and energy. Washington now ranks third-highest in the nation for fuel prices, and the average gallon of diesel sits above $5.00.

In a rural county like Clallam, where nearly every product arrives by diesel-powered trucks, this isn’t a statistic—it’s a direct hit on every household’s budget. We feel these cost increases in every gallon of milk, every building material, and every trip to the grocery store.

When "essential" services follow years of non-essential spending

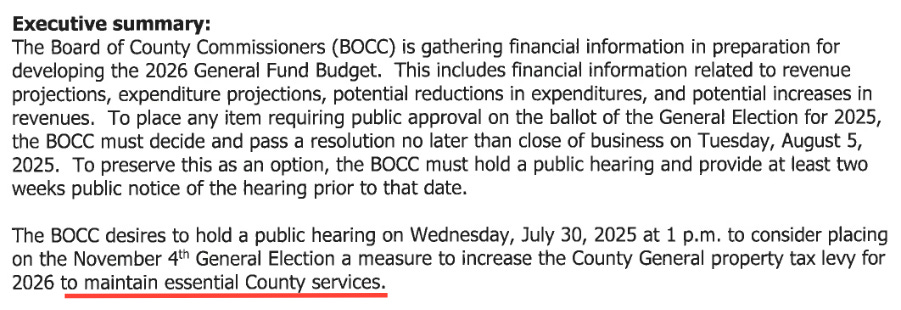

Now, local government wants more. The Board of County Commissioners is preparing a November ballot measure to increase the General Property Tax levy for 2026, claiming the money is needed to "maintain essential county services."

But here’s the question: What happened to cutting non-essential services first?

Clallam County taxpayers already fund:

A County Poet Laureate

Over $12,000 per year in pizza for drug users through “harm reduction” programs

Support for luxury-level permanent homeless housing at a cost of $350,000 per unit

And an entirely avoidable $1.5 million expense to finish just 0.6 miles of Towne Road—after turning down a state grant that would’ve funded it without using county money.

That road, Towne Road, was explicitly flagged by staff as a financial red flag. But the Commissioners moved forward anyway. And now, with coffers strained, they want to talk about protecting "essential services"?

This is the oldest political trick in the book: Spend freely, then scare voters into approving new taxes by threatening cuts to public safety, emergency services, and other essentials.

The hits keep coming: fire district and conservation district fees

Fire District 3, serving the Sequim area, is also asking voters to approve a significant levy increase—from $1.11 to $1.50 per $1,000 of assessed value. For the average home in Sequim, now worth $580,329, that’s a jump from $644 to $870 per year—a 35% increase.

Meanwhile, the Clallam Conservation District is floating the idea of a new parcel fee, with a public presentation this Friday in Port Angeles. It’s yet another hand reaching for the taxpayer’s wallet, even as elected officials campaign on housing affordability while advancing policies that do the opposite.

We’re not Mercer Island or Aspen—we’re Clallam

This isn’t some elite enclave with six-figure tech jobs. This is Clallam County—a place economically distressed enough to qualify for $35 million in federal workforce relief, grouped with places like Puerto Rico and parts of rural Alabama.

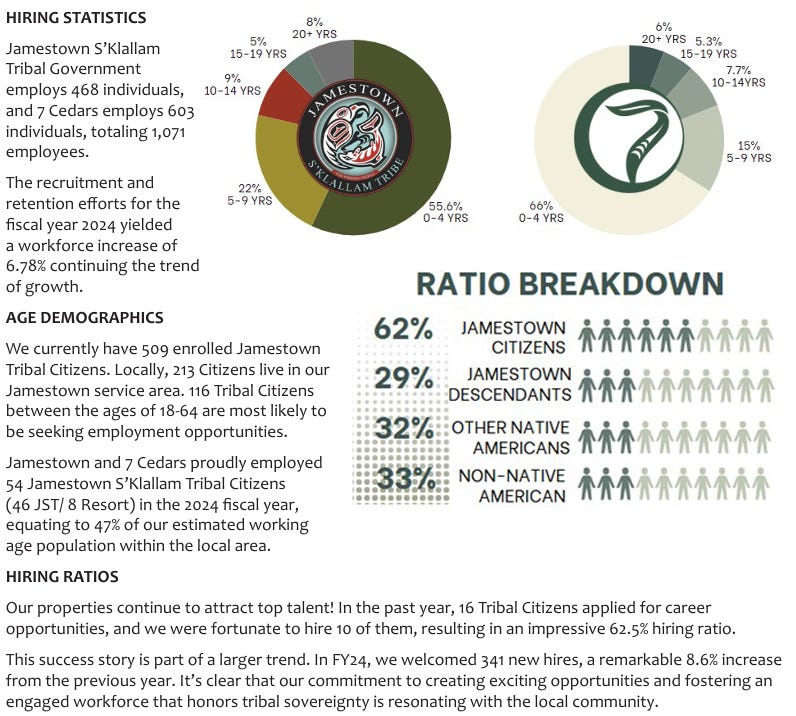

Our largest employer, Olympic Medical Center, is in financial freefall. Our second-largest employer, the Jamestown Tribe, is a sovereign tribal government, which publicly emphasizes prioritizing jobs for tribal citizens—while acres of taxable land continue to be converted into federal trust, exempt from property taxes altogether.

Every time that happens, the burden on the remaining tax base goes up. And those conversions are accelerating.

A reckoning is coming

At some point, we must face a basic truth: We cannot tax our way into prosperity. We cannot keep approving levies, parcel fees, and bond measures while our population ages, our workforce shrinks, and our public services strain under the weight of bureaucracy and mismanagement.

If our leaders are serious about protecting essential services, they must prove it—not by asking for more money, but by cutting waste, reassessing priorities, and respecting the limits of taxpayers who are already tapped out.

Because if we keep going down this road, it’s not just a tax hike we’re facing.

It’s a collapse.