Clallam County officials say they’re just trying to “keep the Ford Pinto running,” but taxpayers feel like they’ve been billed for a luxury ride while getting budget scraps in return. With a proposed levy lid lift on the table and five-year property tax hikes nearing 45%, residents are pushing back against a system where rising costs, bloated payrolls, and state mandates take priority over local needs. This guest opinion breaks down the numbers, exposes the gaps, and calls for a return to common-sense governance—before another Cadillac ends up in the garage, running on empty.

By Jake Seegers, Guest Contributor

Before the Clallam County Finance Committee convened on July 24, 2025, the topic of raising county taxes was already on the table, and not just in dry fiscal terms. Chief Financial Officer Mark Lane quipped, “It’s really just to keep the Ford Pinto running,” prompting laughter from the committee, including Commissioners French and Johnson. Lane went on: “We live in an economically distressed, rural county. We can’t afford the Cadillac of county government!”

Most of us would just settle for a reliable, low-mileage Subaru.

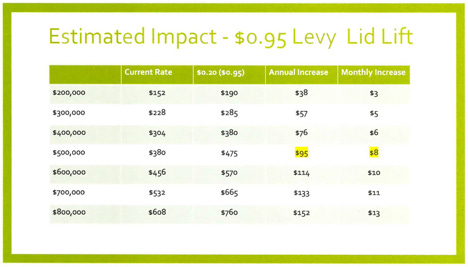

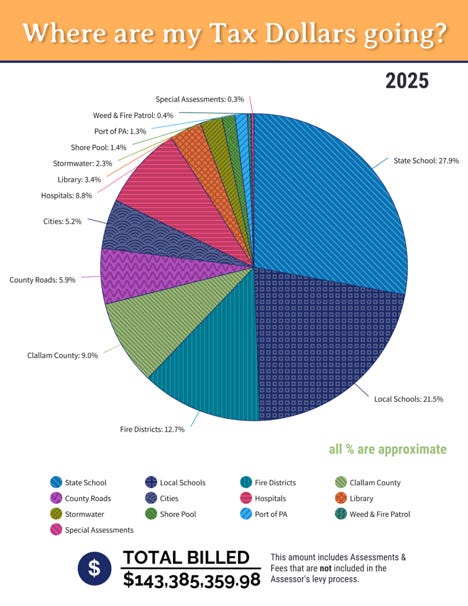

Last week, Clallam County commissioners held a public hearing on a proposed levy lid lift for the county’s general property tax fund. At a special meeting on Monday, August 4, they revised the proposal to raise the levy rate from $0.7598 to $0.95 per $1,000 of assessed property value, while keeping the 1% annual cap on future increases. For context, this change would add about $95 per year in property taxes for a home assessed at $500,000.

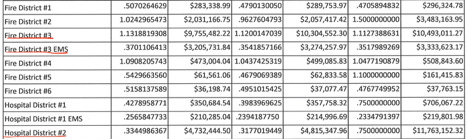

The county’s general fund makes up about 9% of the total property tax burden for Clallam County taxpayers and is used to fund essential government services. These include public safety, health and human services, courts, jails, public defenders, the assessor’s office, planning and permitting, juvenile and family services, and parks and recreation.

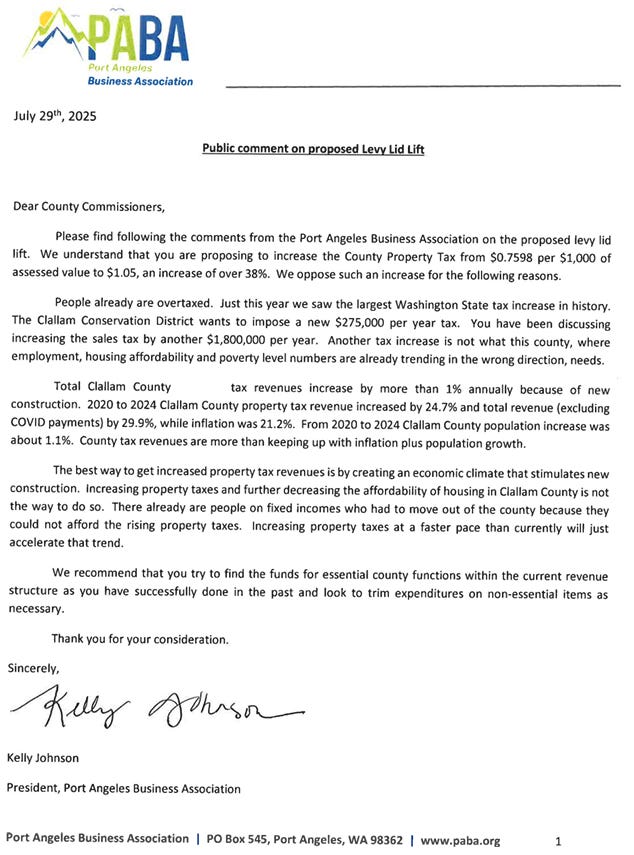

The community’s stance has been clear: overwhelming opposition to the commissioners’ proposed levy lift for the county’s general fund. Numerous comments and a letter from the Port Angeles Business Association echoed a common refrain: lower-than-average incomes, unaffordable housing, and an increasing tax burden are driving long-time residents out of Clallam County.

David Moody, a retired electrician on a fixed income, summed it up:

“I understand the situation that [the county] is in, but you have to understand the situation we’re in as taxpayers. A little here, a little there…but it all comes out of my pocket. I’m paying almost $18 a day to live in my home. I’m going to have to move away from this place, and I’ve lived here my whole life.”

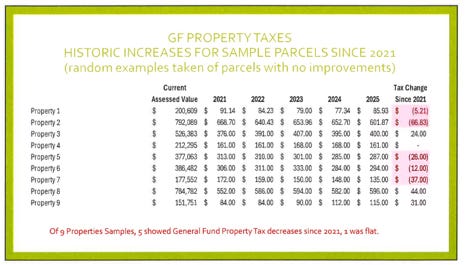

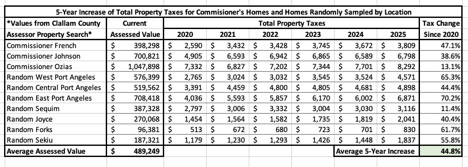

Still, County Administrator Todd Mielke and the commissioners countered that the general fund’s impact on property taxes has been modest. They presented a random sampling from the Assessor’s Office and tax data from their own homes to make their case.

But if the general fund increase is so minor, why does it feel like we’re footing the bill for a Cadillac and getting handed the keys to a Pinto?

Because we are. Just not in the way you might think.

Although the county’s general fund, which accounted for only 9% of total property taxes in 2025, is not the primary culprit, the total property tax burden has soared over the last 5 years. A sampling of homes, including those of the commissioners, showed a 44.8% average increase in total property taxes over five years.

What changed outside of the general fund? Since 2020, voters have approved several levy increases across junior taxing districts, including fire districts, hospitals, and schools. The associated property tax obligation is alarming. Today, Olympic Medical Center receives nearly the same amount of property tax revenue as the county’s general fund. Fire District 3 receives more, even before voters approved another 35% hike on Tuesday.

Meanwhile, over 50% of your property tax goes to state and local school levies.

According to U.S. News, the cost per student in Clallam County is now $15,784 per year. (Source)

And while commissioners may not directly control school or hospital levies, they’ve consistently supported them by passing resolutions in favor of OMC and school districts in Port Angeles, Sequim, and Forks. That makes them, at minimum, willing participants in a system many now view as inequitable.

Spending Beyond Our Means

From 2018 to 2024, the Bellevue CPI (the inflation index used by Clallam County) rose 30.4%.

In that same period:

County tax revenues (property + sales tax) rose 39.3%

Expenses rose 51.6%

Federal and state grant revenue ballooned 125.7%

(Source: WA State Auditor’s FIT Tool)

That gap between revenues and expenses? Grants filled it. But grants come with strings. And staff. And expectations.

Once hired, staff are hard to let go…even when grant dollars disappear. That’s why the Clallam Conservation District is now proposing a $5 per parcel fee, hoping to secure local funding to backstop the uncertainty of grant-dependent salaries.

Local commenter Kaj Ahlburg said it plainly:

“I think the county needs to be able to live within the framework of inflation plus population increase. If we continue to see payroll increase at more than twice the inflation rate increase…I believe that is an important part of the problem.”

The Bigger Picture: Mandates and Misplaced Priorities

Blame doesn’t rest solely at the county level. State and federal mandates, driven by political priorities rather than local need, are saddling Clallam County with expensive obligations and mandated spending.

At last week’s budget meeting, Community Development Director Bruce Emery warned that further staff cuts could jeopardize Clallam’s “local obligation for salmon recovery and environmental quality repair.” Meanwhile, Administrator Mielke referenced a looming $1.5 million price tag to retrofit county buildings for state-mandated energy efficiency upgrades.

While salmon recovery and energy conservation are noble pursuits, governments must prioritize “needs” ahead of “wants,” just like their citizens. When our elected representatives get this backwards, we end up with counties, like Clallam, where public safety is significantly underfunded compared with state and national averages. We end up with a busted budget that must be frantically taped together with a levy lid lift.

What Can We Do About It?

1. Vote for “Needs” Before “Wants”

Who we vote for matters. Who our elected leaders vote for matters. Finally, how we vote matters. If you abstain or cast a throwaway vote, you’re statistically supporting the candidate furthest from your values. (Ahem, Jeff, are you listening?). Even in Washington State, every vote counts. Breaking ties with the defeatist herd mentality that says otherwise will undermine policy that mandates “wants” over “needs”.

2. Be Persistent. Be Insistent. Be Heard.

Public pressure works. Overwhelming opinion can, and does, shift decisions. (Luke 23:23-24) Attend meetings. Submit comments. Raise your voice. I’ve seen the impact firsthand.

3. Replace Elected Leaders and Step Up

Why not you? Run for office. Take a leadership role. Olympic Medical Center, for example, is a leadership vacuum waiting to be filled by capable community members.

If we can band together with our voices, our votes, and our time, we just might finally get that Cadillac we’ve been paying for. Then we can sell it and buy the Subaru.

Jacob Seegers is a husband, father, and Ohio State MBA graduate living in paradise - Clallam County, WA.