At a recent budget meeting, County Assessor Pam Rushton and the commissioners showcased the tech and tactics now used to track every property and structure in Clallam County. High-definition aerial imagery, street-level LIDAR, and AI-powered valuation software are being deployed to raise assessed values — all during a levy-lift year. With voters being asked to raise a portion of their property taxes by 30%, questions about privacy, oversight, and aggressive prosecution loom large. Citizens are urged to pay attention, dispute assessments where appropriate, and weigh in before the November vote.

By Jake Seegers, guest contributor

The Commissioners are Watching

That became evident during last week’s departmental budget meeting with the County Assessor. From high-definition aerial and street-view imagery contracts to experiments with artificial intelligence, the commissioners appear intent on ensuring that the Assessor’s Office has every possible tool to maximize tax revenue.

Technology funded by taxpayers is now being used to tighten the tax noose around those same taxpayers. Every last cent will be collected — and noncompliance will be swiftly prosecuted. Landowner privacy seems to be inconsequential.

Power of the Assessor

During the meeting, County Assessor Pam Rushton took the lead, firmly stating that her office could not withstand any further staff reductions.

Rushton claimed that limited staffing prevents her team from meeting state mandates, such as verifying senior exemptions, valuing personal property, and auditing land-use claims. The commissioners accepted her assertions without question.

Commissioner Mark Ozias sympathized:

“I understand. You can only juggle so many things, and that’s just realistic.”

Other department heads have to fight to justify their budgets. The Assessor, however, knows her leverage: the commissioners depend on her office to fuel their spending habits — especially as they urge residents to approve another property tax hike through a levy lift.

Gaming the Levy Lift

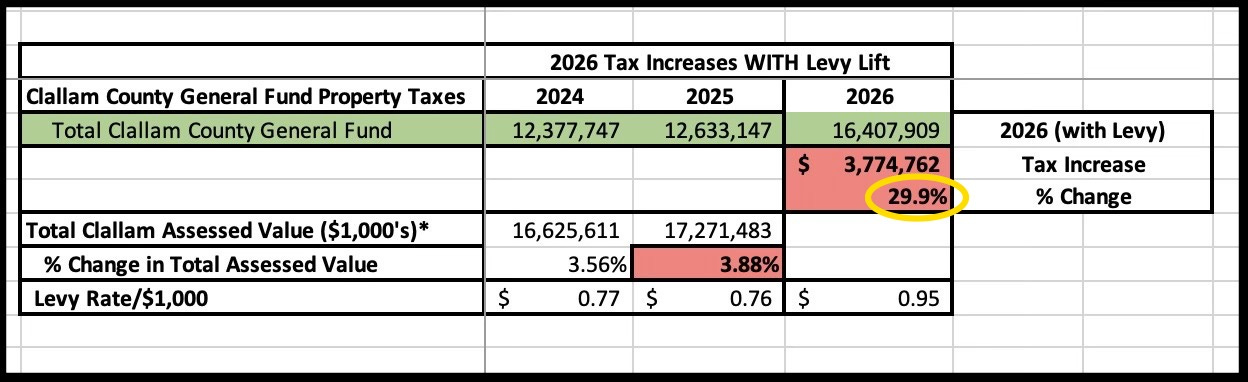

On this November’s ballot, commissioners are asking voters to approve a levy lid lift from $0.7598 to $0.95 per $1,000 of assessed value — a $3.8 million annual tax increase for the county’s general fund. If approved, general fund taxation would jump by 30%.

State law limits counties to raising property taxes by just 1% each year, unless voters approve a special increase known as a levy lid lift.

When voters say yes to a levy lid lift, that 1% limit disappears for the year of the levy lift, and the county can collect tax on the full, updated value of every property.

So, if property values go up at the same time the levy lift takes effect, the county’s total tax revenue jumps sharply, because the new, higher tax rate applies to the new, higher property values.

In other words, raising property values and raising the tax rate in the same year significantly increases the impact on taxpayers.

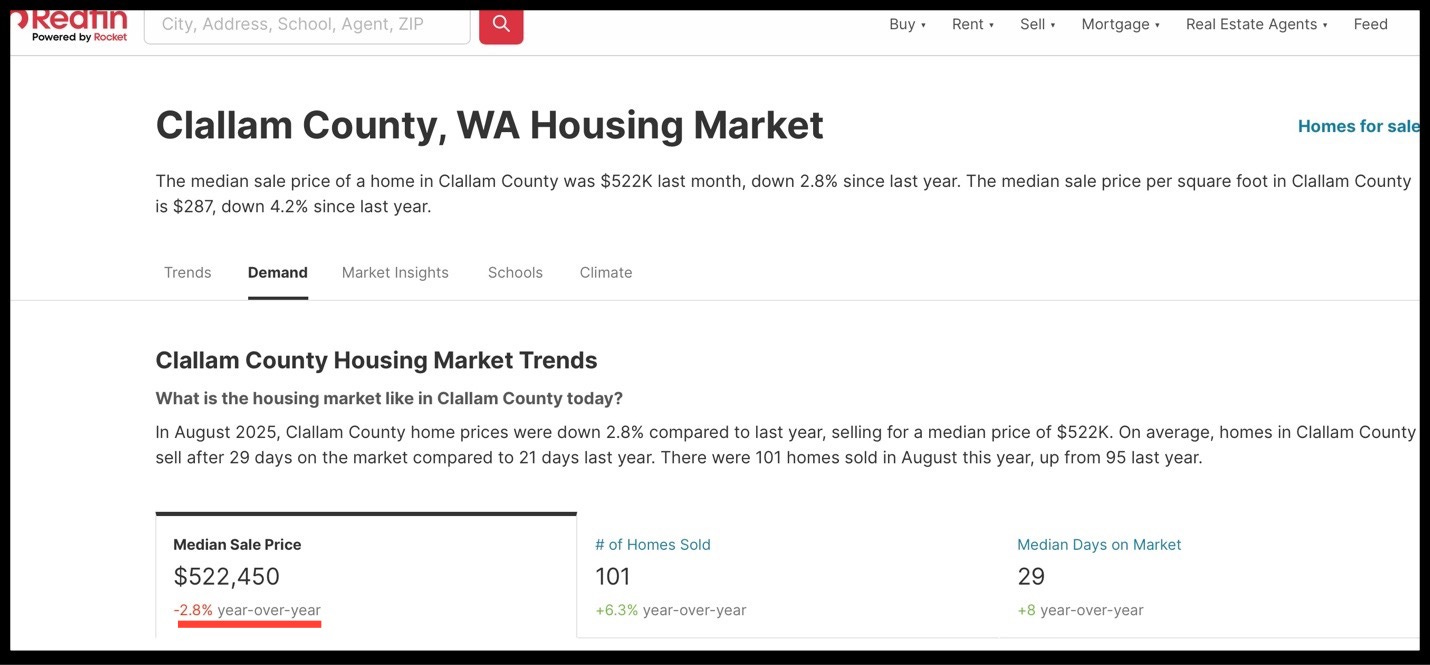

Interestingly, the Assessor’s 2025 preliminary estimate shows a 3.9% increase in total assessed value. Yet, according to Redfin, average home sale prices in Clallam County have fallen 2.8% since August 2024.

In other words, while the market is softening, many homeowners will still see their taxable property values rise by about 3.9% — some higher, some lower.

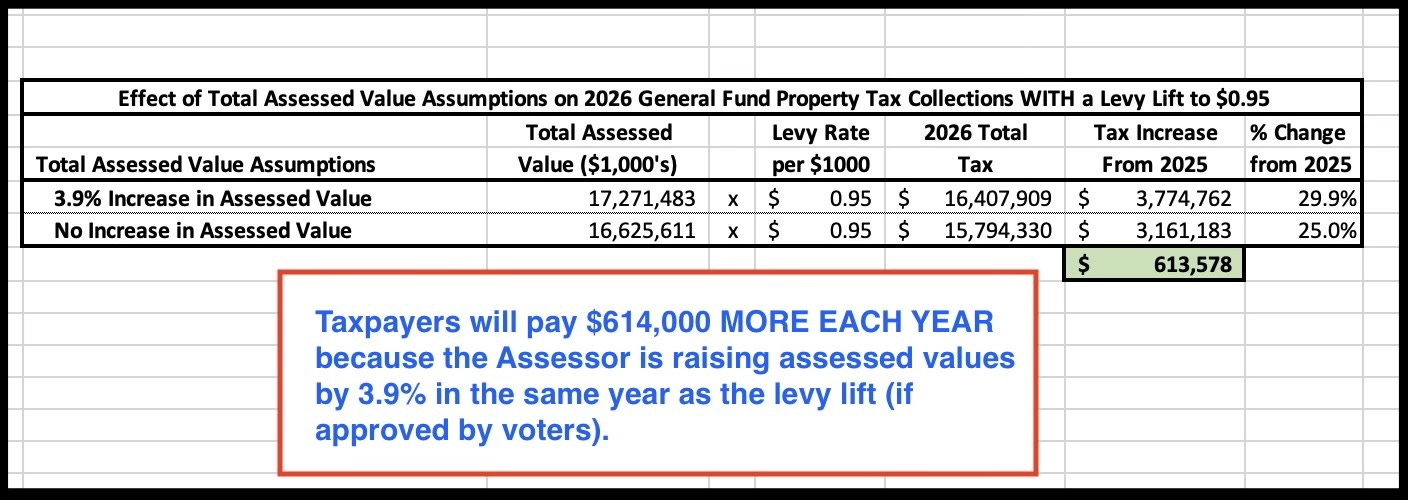

That 3.9% jump, calculated by the Assessor, means the proposed levy rate of $0.95 would apply to a higher base — producing $614,000 more in general fund property tax than if assessments had remained unchanged.

If the levy passes, property tax collections from the county’s general fund will rise by nearly 30% next year.

While there’s no proof of deliberate assessment inflation, one thing is clear: the commissioners are eager to equip the Assessor with technology capable of maximizing assessments so that they can collect more taxes.

Eyes in the Sky: EagleView

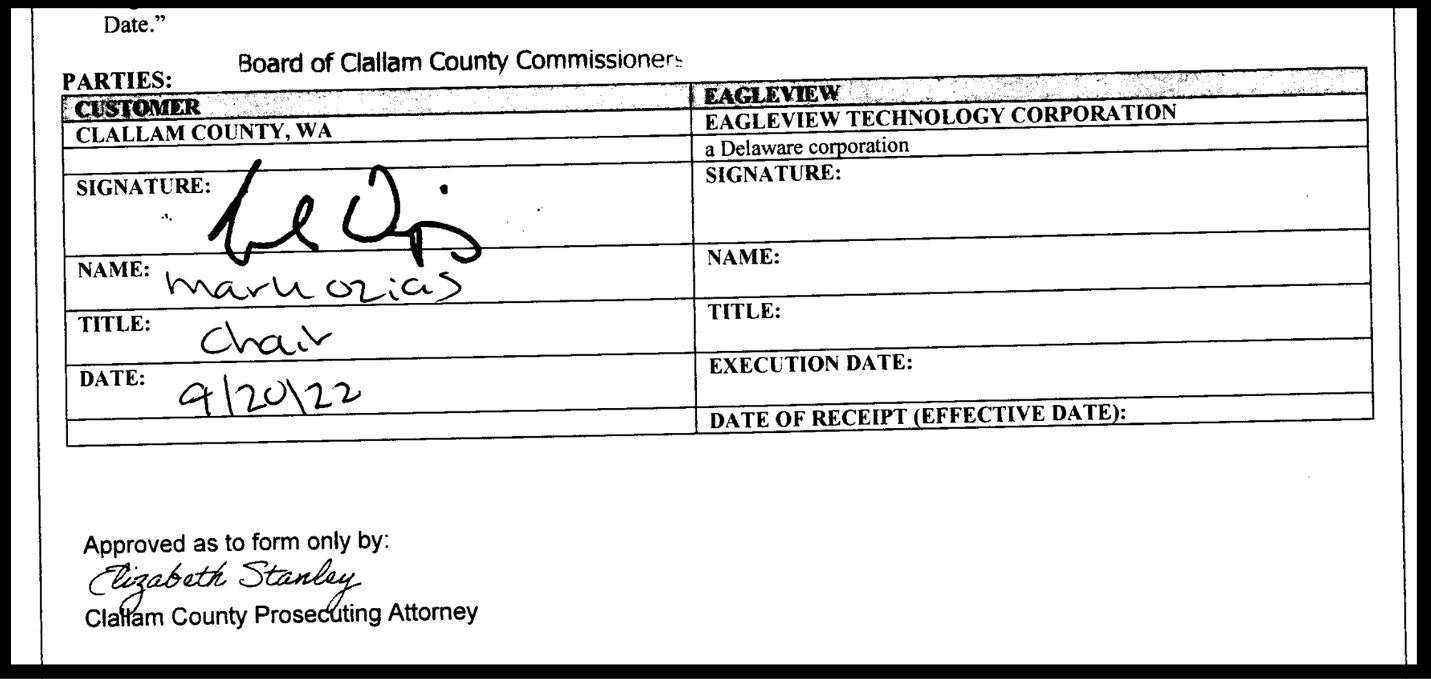

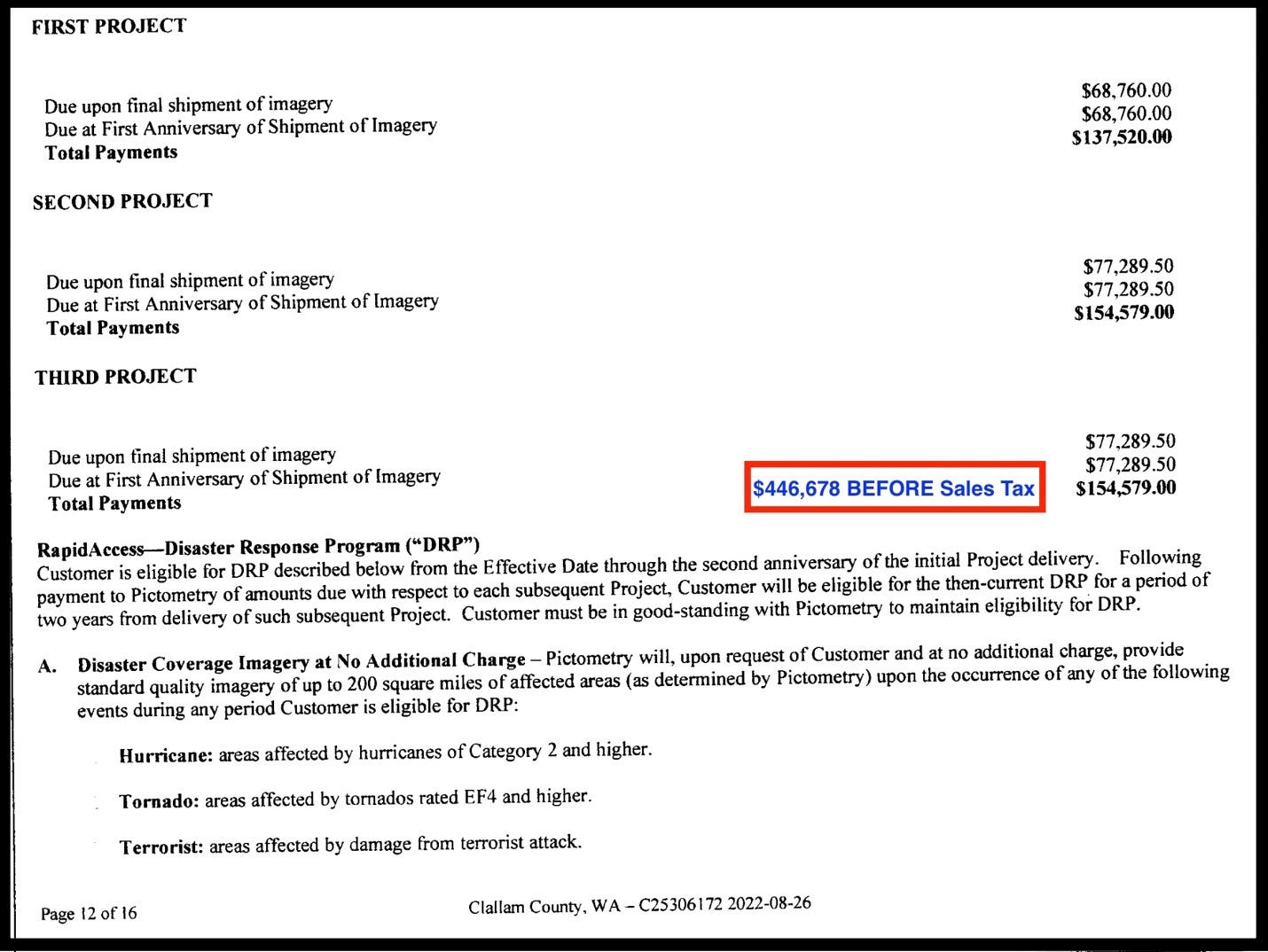

In late 2022, the Board of Clallam County Commissioners signed a $500,000 contract with EagleView Technology Corporation to acquire high-definition aerial imagery, along with related software, services, and training.

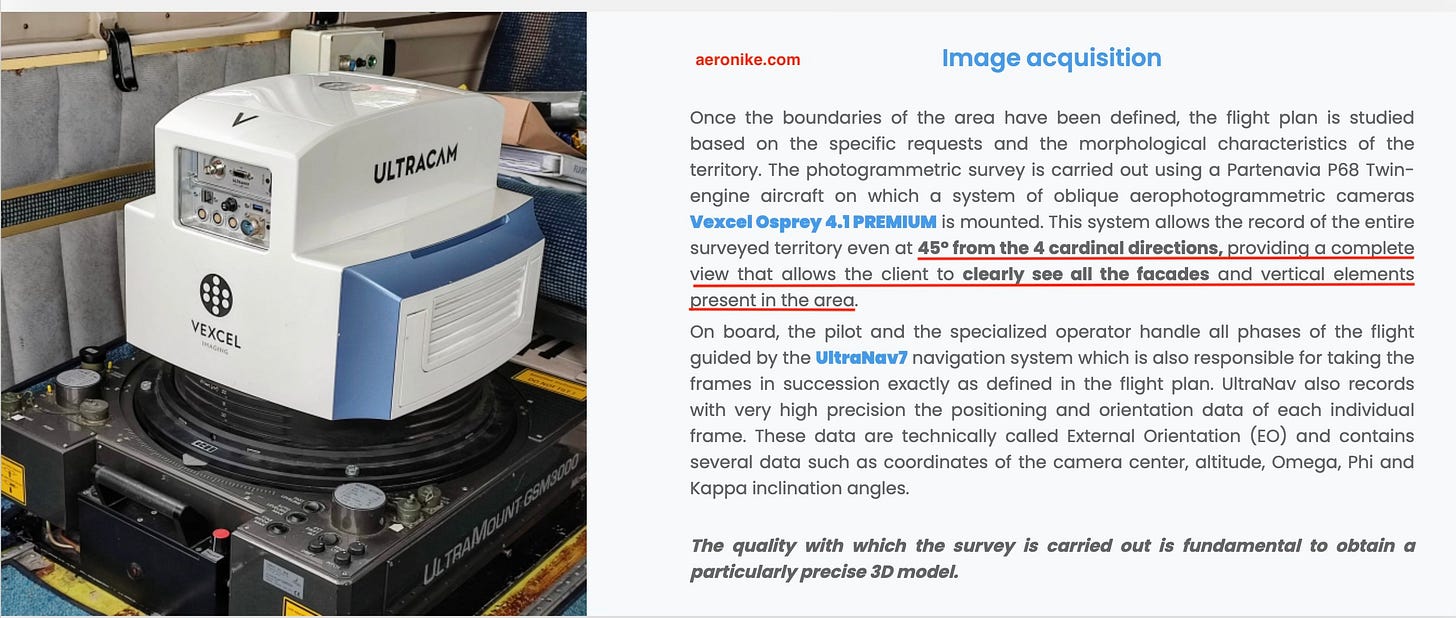

The images are recorded by manned small twin-engine aircraft equipped with high-resolution cameras. EagleView competitors like Eagle Eye and Aeronike use similar systems, mounting cameras on Cessna-class survey planes to collect oblique imagery from several directions.

To achieve sub-inch accuracy, these aircraft fly multiple passes with view angles up to 45 degrees and altitudes as low as a few hundred feet, depending on the target resolution and airspace restrictions. Aernonike’s website states:

“This system allows the record of the entire surveyed territory even at 45° from the cardinal directions, providing a complete view that allows the client to clearly see all the facades and vertical elements present in the area.”

A demonstration by Eagle Eye shows how the aircraft circles its survey area, recording imagery with less than one-inch precision from multiple viewpoints — producing detailed, three-dimensional visual models of every structure below.

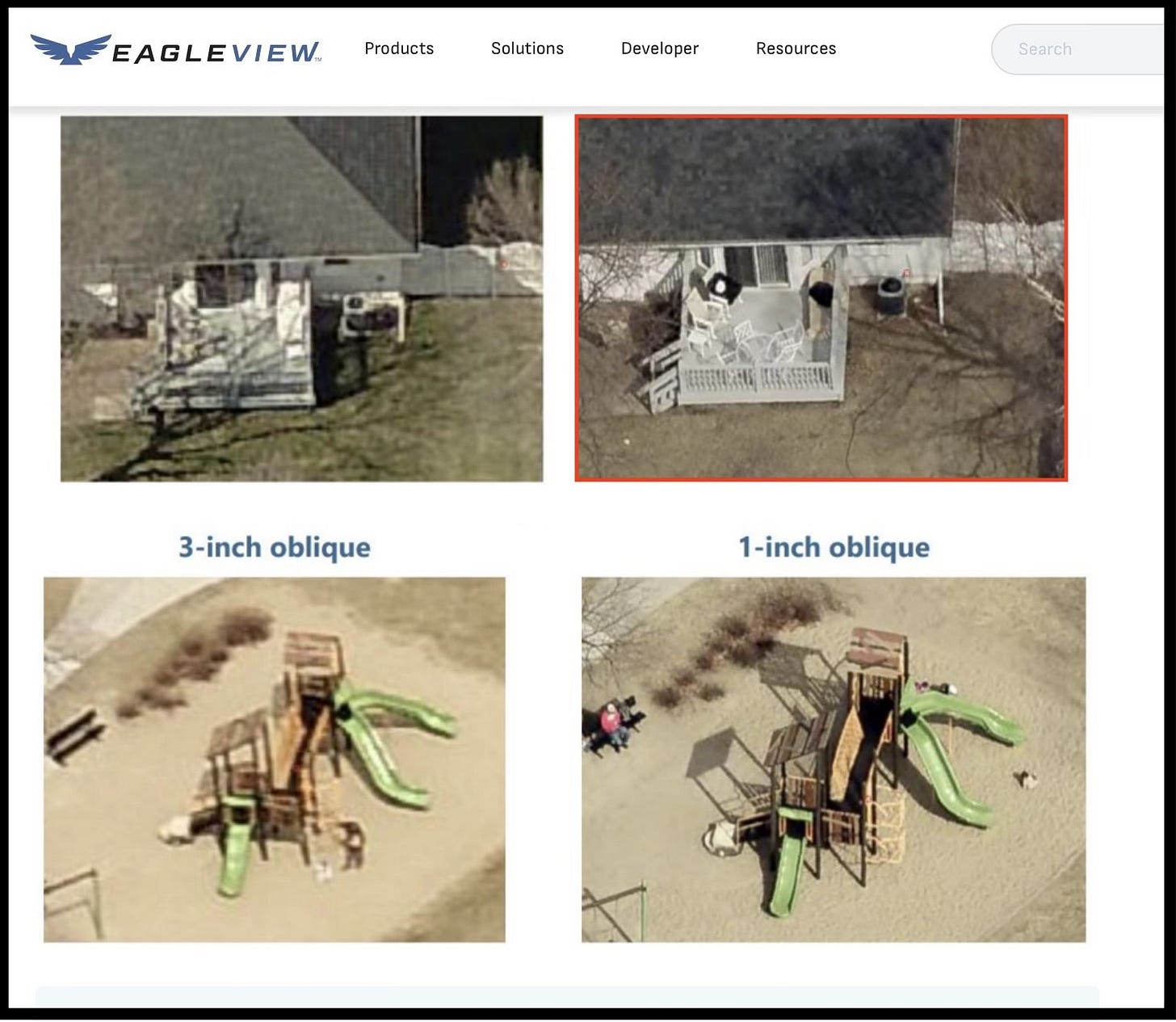

EagleView, Clallam County’s contractor, is capable of accuracy to under one inch from multiple angles. The company claims the ability to read text on road signs and manhole covers.

One county employee confided that when the planes make their passes, the resolution is so sharp that homeowners outside during recording could potentially be recognized.

So, will the Assessor — and the Commissioners — be joining your next backyard barbecue uninvited?

Two countywide flight projects have already been completed — in 2023 and 2025 — with a third scheduled for 2027. Each project involves multiple low-altitude flights designed to capture three-dimensional imagery of private property across the county.

EagleView’s technology exists for one purpose: to boost assessed values. Every deck, garage, structure, and bonus room becomes another data point in the county’s ongoing quest for revenue.

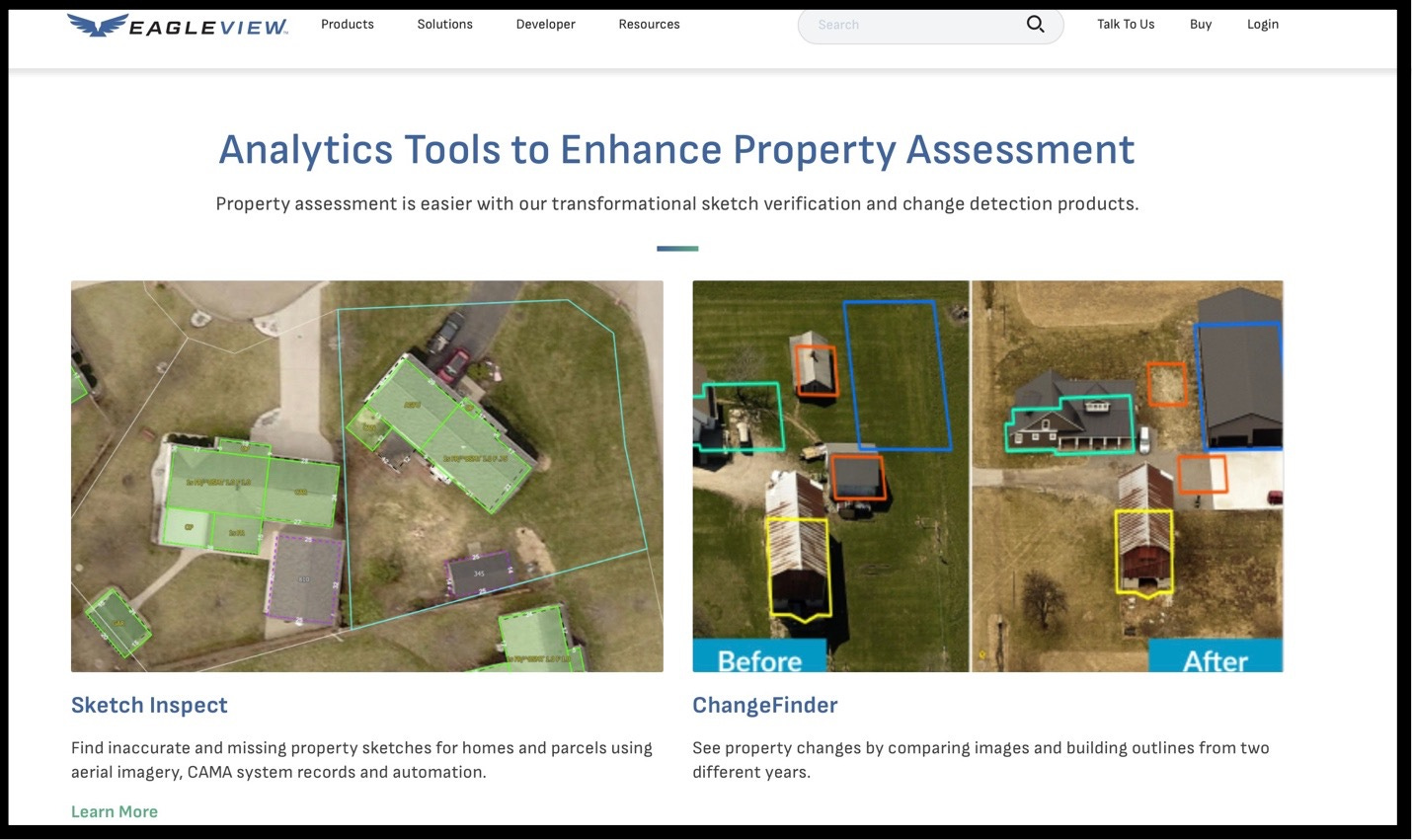

Now, with two years of full flight datasets, the Assessor’s Office is actively using EagleView’s ChangeFinder — software that automatically flags new or expanded structures. Gates, fences, and “No Trespassing” signs are no match for its digital gaze.

With ChangeFinder, the Assessor and her staff can explore detailed 3D imagery of private property — measuring square footage, spotting improvements, and collecting every last penny possible on behalf of the commissioners.

Rushton praised the tool during the budget meeting:

“Yes, that one has been awesome. We can see what was there two years ago and what’s there now… We use that tool a lot. Daily. That’s what’s helped us keep up.”

Chief Appraiser Dan Childress added:

“I have one appraiser right now going through every timberland parcel under 20 acres that’s not large-company-owned — looking for buildings.”

Not once during this exchange did any commissioner raise privacy concerns on behalf of the citizens they represent and who pay their salaries.

In a rural county where seclusion is cherished, the commissioners have authorized desktop surveillance of private property — funded by the very taxpayers being surveilled.

Cyclomedia: Street-Level Surveillance

Dissatisfied with aerial imagery alone, the county also contracted with Cyclomedia, a company that combines LiDAR — short for Light Detection and Ranging, a laser-based mapping technology that measures distance by bouncing light pulses off surfaces — with street-level photography to build a “3D digital twin” of the region.

The price tag: $72,000 for the initial drive-by capture and $8,600 for second-year maintenance.

Cyclomedia’s marketing promises are blunt — higher tax revenues, fewer appeals, and “accuracy within a fraction of an inch.”

Chief Appraiser Dan Childress explained:

“The other thing we’re doing is these desktop reviews — a combination of EagleView, Cyclomedia, and our mobiles — and being able to do actual desktop review on some of these properties.”

Together, EagleView and Cyclomedia have offered a powerful combination driving up assessed values during a levy-lift year — even as actual home prices soften.

Cities within the County haven’t yet joined the program, but commissioners are eager for them to share the bill for the county’s growing espionage habit. The Assessor’s Office has already courted Port Angeles and Sequim, both of which have shown interest in adopting the commissioners’ model for privacy intrusion and taxpayer-funded surveillance.

AI Is Next

Artificial intelligence is next on the commissioners’ wish list.

Rushton recalled,

“There was a software presentation last year with some AI in it, and it was amazing.”

The software in question — ValueBase — advertises “time-saving valuation tools” and even offers training modules on “handling upset taxpayers.” Listen to it HERE.

Compliance or Prosecution

During the meeting, Rushton described a recent senior tax exemption case that raised red flags. She said she personally visited the property and believed the owners no longer lived there.

Without hesitation, Commissioner Mike French asked:

“Do you refer that to the prosecutor?”

He added:

“I’m on the election board. We refer things to the prosecutor all the time when we think there is intent.”

Yet last year, in an email to a concerned citizen, Commissioner French wrote:

“Our country was built on the premise that the people should be able to protest their rulers, and I do not believe that property destruction categorically discredits a political protest.”

When county regulations and taxes push Clallam residents to choose between compliance and survival, French’s instinct is swift and punitive — prosecute tax evasion immediately.

It was Chief Appraiser Childress who finally injected reason:

“Some of it is very difficult to monitor. We gotta make sure you live here this many days. How are we exactly going to police that?”

Shouldn’t fraud be proven before prosecution is pursued?

The November Choice

Before voting on the levy lid lift this November, taxpayers should remember this:

Your commissioners have already spent your tax dollars on technology that drives higher assessments, monitors private property, and puts residents at risk of prosecution — all while using the very funds you provide.

Here’s what you can do:

Vote no on the county’s levy lid lift.

Dispute your property assessment within 30 days of receiving it — every challenge counts.

Speak up to your commissioners about the importance of privacy and fair treatment for all property owners.

All three county commissioners can be reached by emailing the Clerk of the Board at loni.gores@clallamcountywa.gov.

Last Sunday, Jake Seegers asked readers if the commissioners should consider the advice of activists who condone breaking laws. Of 169 votes:

91% said, “No, that crosses the line”

5% said, “Yes, sometimes disruption is good”

4% said, “Maybe, if their point is valid”