After quietly resigning from First Fed amid financial turmoil and a $5.8 million legal settlement, former CEO Matt Deines remains on key local boards—despite no longer working for the bank and not living on the Peninsula. As risky investments and unanswered questions pile up, it’s time to ask: Are local institutions protecting the public—or protecting each other?

Update: After initially telling the Peninsula Daily News on July 16 that he would continue serving on the board of the Clallam Economic Development Council, Matt Deines resigned on July 17 and has been removed from their website.

Matt Deines may be gone from First Fed, but his fingerprints are still all over Clallam County.

After quietly resigning as CEO of First Northwest Bancorp—the parent company of First Fed Bank—Deines left behind a cloud of unanswered questions, financial losses, and a $5.8 million bank settlement tied to a collapsed fintech Ponzi scheme. But while he's no longer running the bank or living in Clallam County, Deines continues to hold leadership roles in several high-profile local institutions.

He still serves on the board of the Clallam Economic Development Council (EDC) and Field Arts & Events Hall, and remains involved with Meriwether Capital, a firm he helped fund—ironically—using First Federal assets.

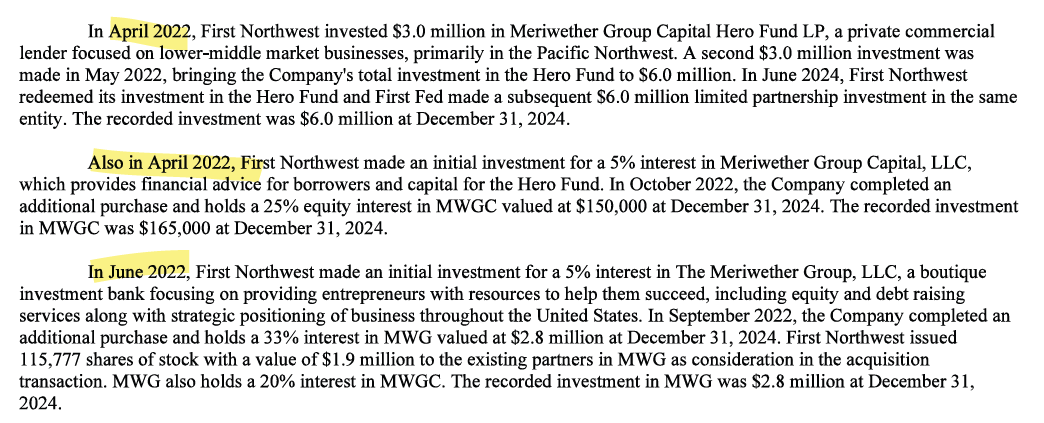

The Meriwether tangle

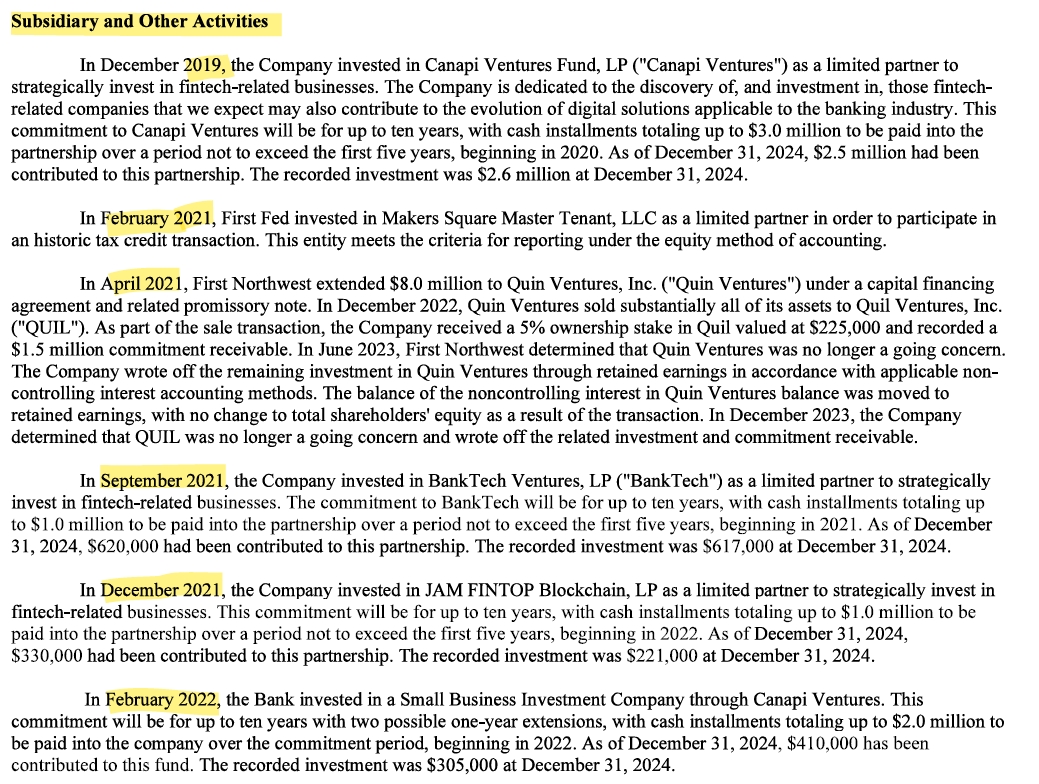

Under Deines’ leadership, First Fed invested in several specialty finance entities tied to Meriwether:

Meriwether Group Capital Hero Fund LP

Meriwether Group Capital, LLC

The Meriwether Group, LLC

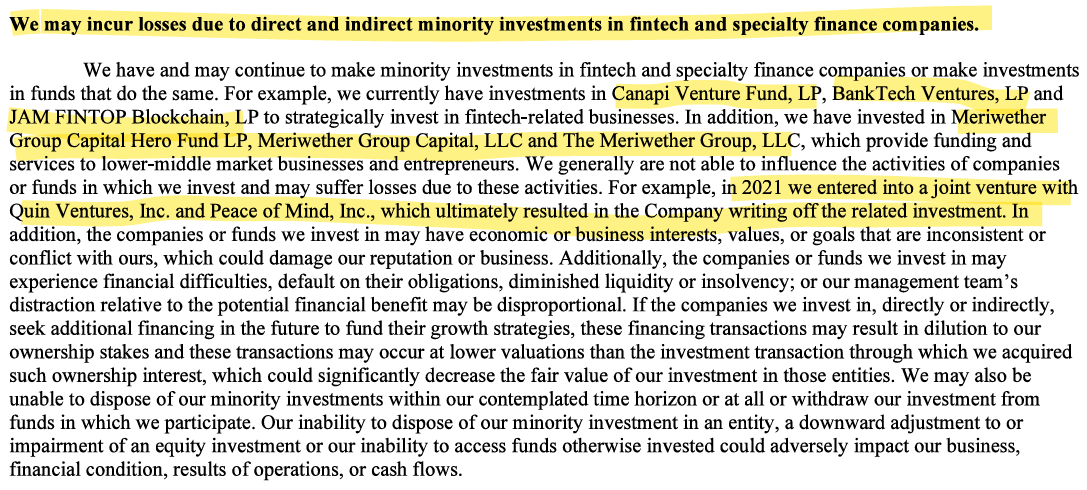

These entities were promoted as solutions for “lower-middle market” businesses, but like many private equity ventures, they carried steep risks—risks First Fed acknowledged in its own disclosures. The bank even noted that it has no control over how such entities operate, and flagged conflicts of interest and reputational exposure as key concerns.

In other words, Deines positioned the bank—and its depositors—in speculative territory with little oversight. And it’s not the first time First Fed was burned.

Back in 2021, a fintech joint venture with Quin Ventures and Peace of Mind, Inc. failed completely. The entire investment had to be written off.

The $5.8 million settlement no one’s talking about

Fast forward to 2024. A tangle of bankruptcies involving Creative Technologies, Refreshing USA, and Ideal Property Investments exploded into an adversary proceeding—essentially a lawsuit—against First Fed, alleging “constructive fraudulent transfer” and seeking to undo millions in questionable transactions.

The result? First Fed, under pressure, agreed to a July 2025 settlement requiring them to walk away from liens and pay up to $5.74 million to clean up the mess.

The bank’s own 8-K filing calls the settlement “in the best interest” of the company—but that’s a hard sell to depositors and shareholders already reeling from other speculative losses.

Still in power, still unaccountable

Despite the mounting red flags, Deines remains in positions of influence over the county’s economy and cultural infrastructure. He’s still on the board at the EDC—an agency responsible for steering business strategy and attracting new investment to Clallam County. He’s still helping shape policy and fundraising at Field Hall—a major recipient of public and private support. And he still sits atop Meriwether Capital’s leadership, an entity that may yet pose further financial risk.

“He said he planned to continue serving on the boards of the Clallam Economic Development Council and Field Arts & Events Hall.” — Peninsula Daily News

All of this, while declining to answer questions about his resignation.

In a brief statement to the Peninsula Daily News, Deines said he “couldn’t speak about the lawsuit or events leading up to his departure, but that he stood by his comments.” He confirmed he plans to remain involved with local boards.

So what now?

That’s the question plenty of residents are asking: Why is someone who resigned from First Fed amid financial and legal scrutiny still shaping the future of our county’s economic and cultural institutions?

Who’s vetting these board appointments? Who’s watching the fiduciaries? And why does this look like Clallam County’s version of “failing upward”?

When leadership fails at the top, the damage doesn’t always stop there. It ripples. Through boards. Through nonprofits. Through backroom deals. And through the confidence of an increasingly skeptical public.

One thing is certain: Until there is real accountability—not just on paper, but in practice—Clallam County’s institutions will remain vulnerable to the kind of financial fog Matt Deines left in his wake.