Charity is no substitute for taxes

A closer look at the Jamestown Tribe's contributions

The Jamestown Tribe’s empire made nearly $86 million last year—yet skipped out on paying many local taxes. Instead, they donated less than 1% to community causes and called it generosity. Is that charity, or just a clever PR move? When everyone else is footing the bill, it’s time to ask: is the system equitable?

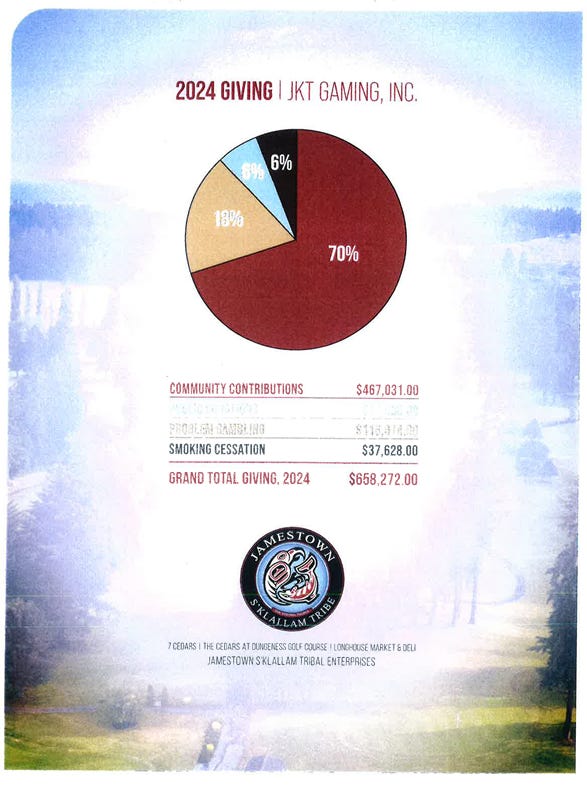

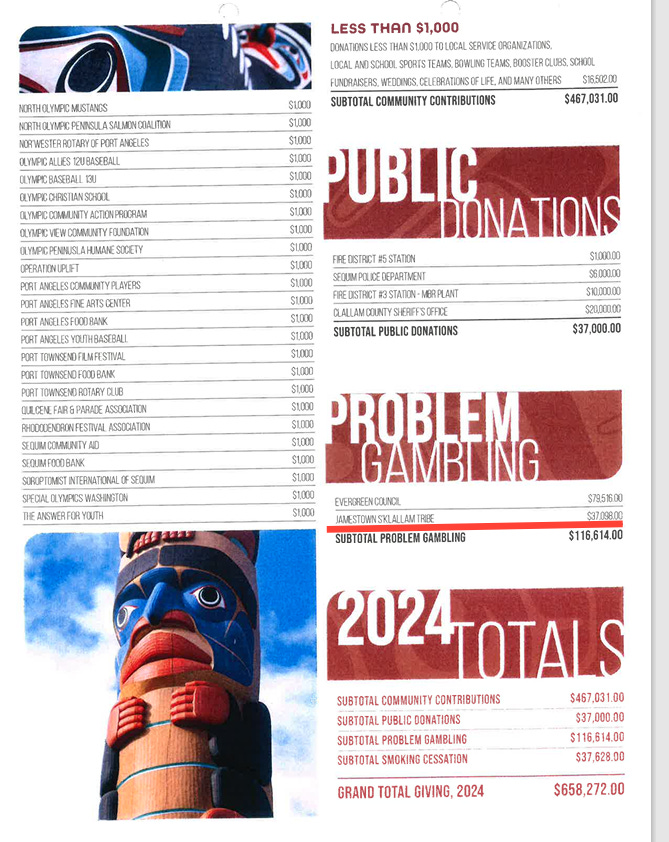

This month, the Jamestown S’Klallam Tribe sent a letter to the Clallam County Board of Commissioners summarizing its 2024 community contributions. “We are proud and honored to be able to go above and beyond any minimum State/Tribal compact commitments,” wrote Jerry Allen, CEO of 7 Cedars Casino. “Year after year, we give more than what is required. Last year, we contributed more than $658,272.00, the majority of that to community causes.”

That’s a generous-sounding number—until you start asking basic questions. For example: what is the required minimum contribution under the Tribe’s gaming compact? The letter doesn’t say. Is $658,272 significantly more than what’s required—is it $200,000 more? $10,000 more? One dollar more? It’s impossible to assess the Tribe’s generosity without that context. And when a for-profit corporation asks to be publicly recognized for its benevolence, that missing context matters.

The Jamestown S’Klallam Tribe, operating through what is effectively a corporate holding structure, does very well for itself. In 2024, the Tribe reportedly generated $85.9 million in revenue. Their self-reported community giving, while appreciated by the recipients, represents less than 0.77% of that revenue.

To put it another way: imagine someone earning $100,000 per year, paying no income, property, or sales taxes, and instead donating $770 to local causes. Then imagine they asked to be publicly praised for going “above and beyond.” Would you find that inspiring—or just a bit performative?

That’s the core inequity. Tribal corporations like the Jamestown S’Klallam’s are not subject to state or local taxes—property, sales, fuel, or otherwise. In some cases, they even collect taxes (like on gasoline) and get to keep up to 75% of the revenue. Their retail operations—including tobacco sales—follow their own tax codes. Under Title 14 of the Tribe’s Cigarette Sales and Tax Code, only cigarettes are subject to unit or sales taxes. Other tobacco products, like cigars and chewing tobacco, are not. The Tribe uses the revenue for its own governmental functions, not for state or county services.

Meanwhile, the rest of us are footing the bill. According to the Institute on Taxation and Economic Policy, the average Washingtonian pays between 10.5% and 13.8% of their income in state and local taxes. On top of that, we pay federal income taxes—another tax that tribally owned corporations are typically exempt from.

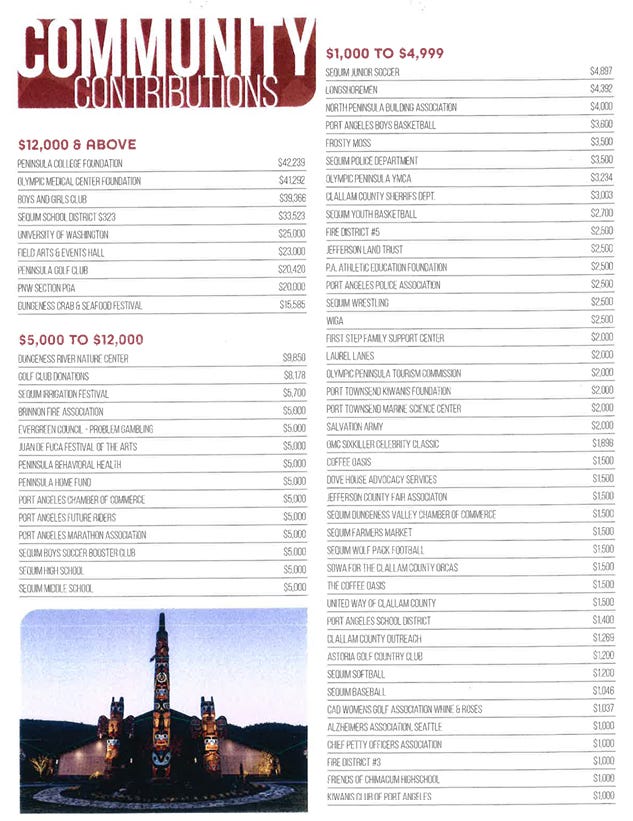

The Tribe's donation list includes many causes we all value: local food banks, police and fire departments, public schools, hospitals, behavioral health services. But these are already publicly funded services—funded by taxpayers. Most of us support these same entities involuntarily, through property and sales taxes—not through discretionary donations and press releases.

Several of the recipients also have close ties to the Tribe or its leadership. The Field Arts & Events Hall, which opens every event with a land acknowledgment to the S’Klallam people. The Dungeness River Nature Center, which the Tribe owns. The North Olympic Salmon Coalition, led by the Tribe’s own Director of Natural Resources. The Hospital’s annual golf fundraiser—held at the Tribe’s golf course. Even “Problem Gambling” and “Smoking Cessation” funds—some of which were simply directed back to the Tribe itself.

There’s nothing wrong with giving to causes you care about. But using charitable donations as a substitute for taxes—and then asking for public praise—is a different matter.

And public officials should be willing to talk about it. At a January Commissioner meeting, Commissioner Mark Ozias declined to discuss concerns about the county’s second-largest employer—the Jamestown Tribe—avoiding paying taxes. He stated that a commissioner meeting was an inappropriate forum for such discussions. However, once the cameras were turned off, he allowed a statement to be recorded:

“We are working on setting up a work session conversation, another public conversation, with the Jamestown Tribe about a variety of tax-related issues — property tax-related issues, lodging tax-related issues, etcetera. So, we’ve been in communication with the Tribe. I expect that to happen sometime in the first quarter, but I don’t have a day yet, and that will be the best opportunity for hopefully a wide-ranging conversation about tax-related issues as it relates to the Tribe and to other Tribes.”

Commissioner Ozias said that meeting would occur during a Monday work session, allowing the public to observe. Yet now, well after the first quarter, it's clear that this was merely another empty promise. The conversation never happened.

When a wealthy, tax-exempt enterprise positions its voluntary donations as more generous than the mandated contributions made by working residents, it risks looking not generous, but self-serving.

At some point, it’s worth asking: is the system equitable? Are the rules fair? And wouldn’t it be simpler—and fairer—if everyone, including the Tribe’s businesses, played by the same rules?

Because no matter how you spin it, donating $658,000 on $85.9 million in revenue isn’t “above and beyond.” It’s 0.77%.

That’s like you making $100,000 last year, donating $770, and expecting a parade. How benevolent.

Or—just maybe—how convenient.

Last Equitable Wednesday, readers were asked if all victims of violent crime in our community receive equal public recognition and support, regardless of their background. Several respondents mentioned that the survey was confusing and that they may have accidentally selected the wrong option. Despite this, here are the results based on 262 votes:

41% voted yes

55% voted no

4% were unsure

There is nothing "fair" about the legal status of those claiming aboriginal heritage. It is the very definition of inequality. I do not know what it might take to be a legally recognized member of the Jamestown S'Klallam Tribe, but whatever that might be is a complete absurdity. A practical byproduct of maintaining these "rights" is incest. This is about ancestral bloodline discrimination. Blatant discrimination, allowing not just full U.S.A. citizenship rights, but special additional rights, privileges and tax advantages. The Native right to fish with woven bark nets and spears exercised with powered boats and nylon monofilaments nets. The native custom of using computers, cell phones, transportation and sanitation systems built by non-natives and let us not forget the highly revered ancient custom of operating casinos. Unless and until all of the JKT becomes equal U.S.A. citizens, they should be both financially and geographically treated like all other foreign nations.

Not only is your article spot on, it points out the need for major changes regarding the tribe. It's bothered me since the MAT clinic opened, that the Jamestown doctors prescribed opioids that got many people hooked, then are allowed to treat them for addiction. Seems kinda like double dipping.