Guest contributor Jake Seegers takes aim at Clallam County’s growing tax burden, arguing that voters are being played by a well-rehearsed political playbook. Since 2020, nearly every levy for schools, hospitals, and fire districts has passed — even as friends and family are priced out of the area. Seegers breaks down the tactics local leaders use to win higher taxes: exaggerating budget threats, framing cuts as catastrophic, offering “compromises” that were planned all along, and reintroducing failed measures until they pass. His message is clear — if you know the playbook, you’re harder to fool and less likely to vote yourself into higher taxes.

By guest contributor, Jake Seegers

While the weight of rising costs are prompting friends and family to leave Clallam County, why do we keep voting ourselves into higher property taxes? Since 2020, voters have approved nearly every levy increase proposed by schools, hospitals, and fire districts.

When it comes to property taxes, we’re losing the negotiation.

The best deal-makers make you feel like you’ve “won” while giving them exactly what they wanted. Local officials have perfected this approach when asking for more of your money. Here’s their playbook.

Step 1: Loss Aversion - Personalize the Threat

In his book, Never Split the Difference, FBI negotiator Chris Voss explains: “People will take more risks to avoid a loss than to realize a gain. Make sure your counterpart sees that there is something to lose by inaction."

Our leaders know this well.

School levy campaigns highlight the looming loss of teachers, sports, music, and arts. Fire districts and hospitals warn of job cuts, reduced emergency response times, and diminished access to care.

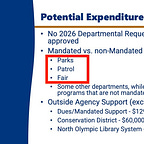

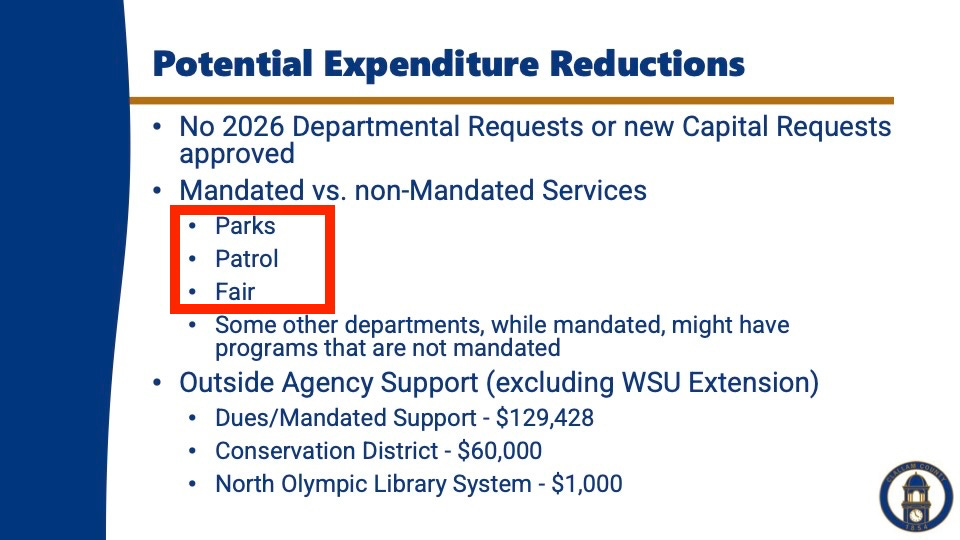

In recent budget talks, Clallam County leaders floated various potential spending cuts. Topping the list were parks, patrol, the fair, veterans’ relief, and public safety.

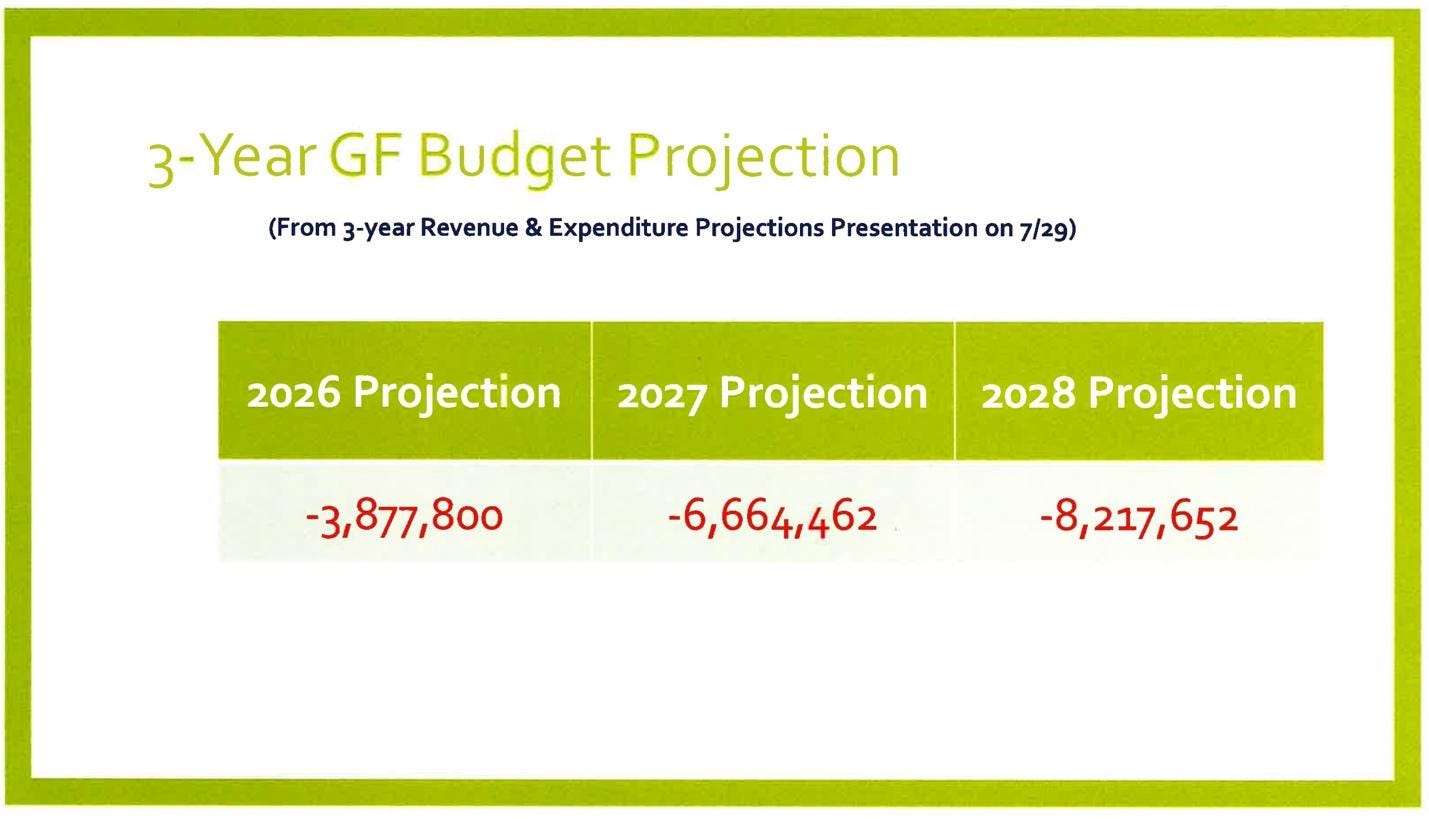

County Administrator Todd Mielke warned of a projected $3.8 million shortfall in 2026, which he equated to roughly 40 full-time employees. Commissioner Ozias pointed to the Sheriff’s Office, Parks, and Community Development departments as likely layoff targets, warning of “significant impacts to service” if cuts were the only strategy.

The real gut punch came when both the Planning/Permits Director and the Assessor claimed their service speed and/or access would drop if further cuts are required. We hate waiting in lines — just ask TSA PreCheck.

The solution? For a mere $8 a month per average homeowner, we can keep our parks, fair, veterans’ services, public safety…and even avoid those pesky lines.

But, prioritizing tax hikes or service cuts before pursuing improved efficiency and smarter spending isn’t leadership—it’s backwards thinking.

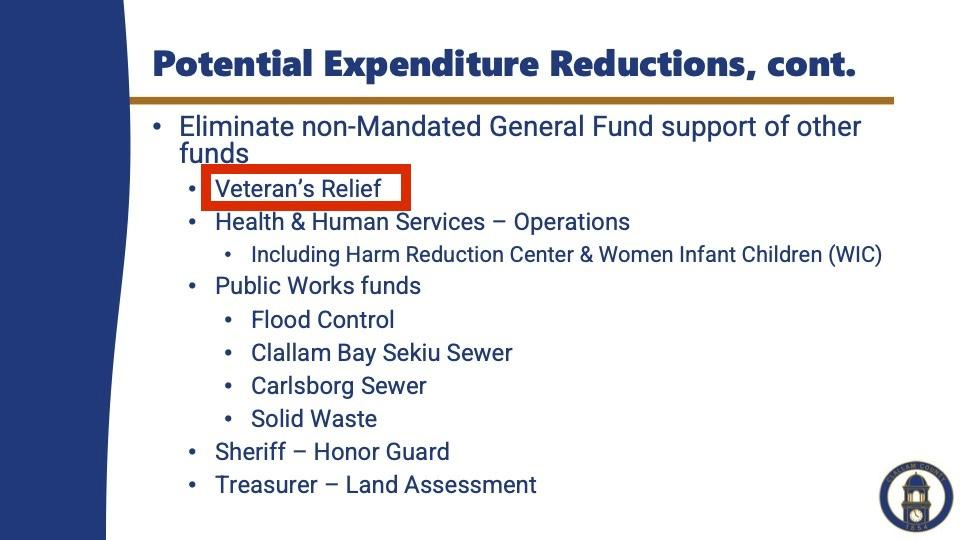

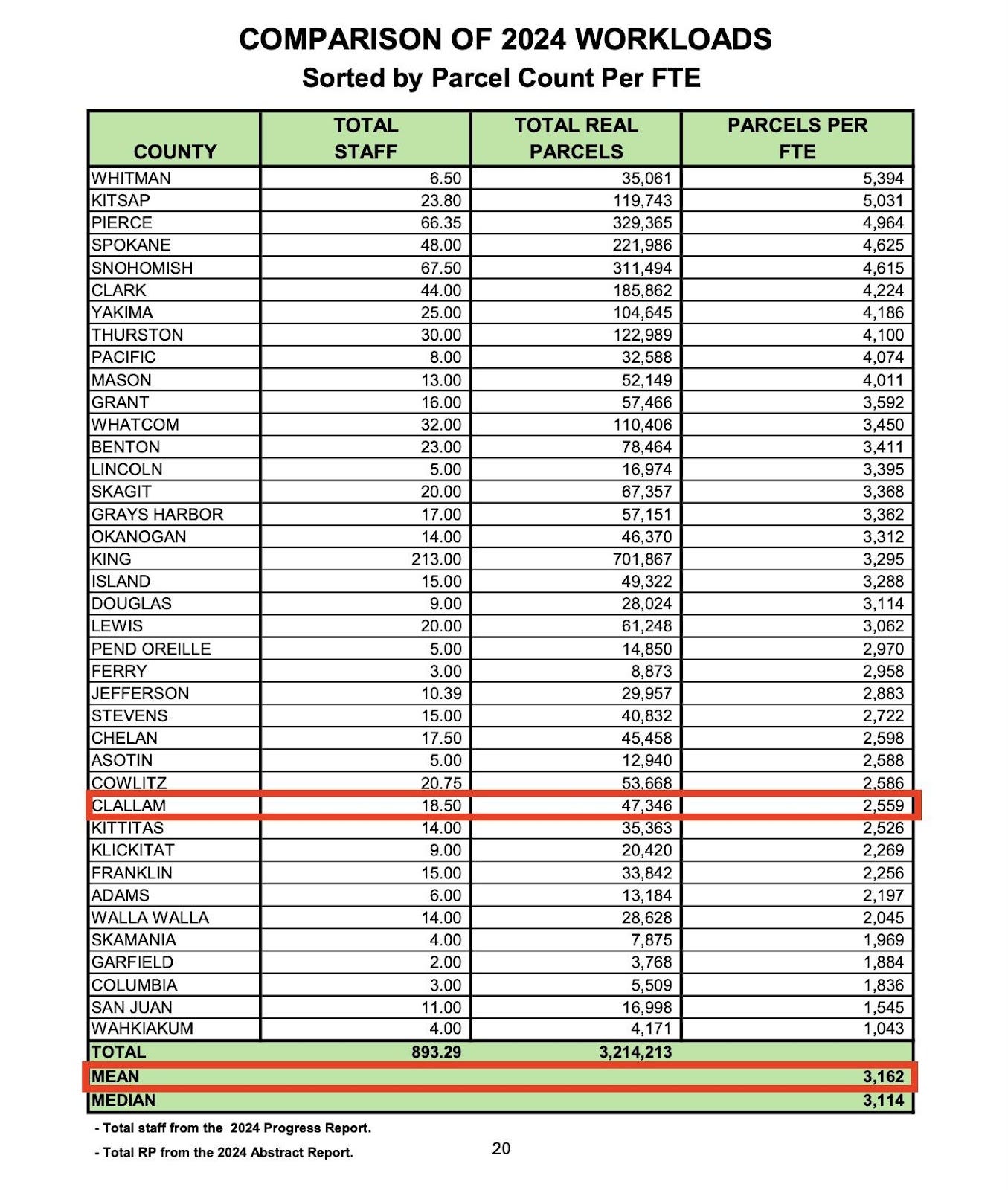

Yet some of our elected officials don’t see it that way. The Assessor’s Office has already reduced its operating hours despite stable staffing and lighter-than-average workload (per WA Department of Revenue data – thanks, Dr. Sarah!).

Step 2: Bend Reality - Exaggerate the Threat

After the finance team predicted an $8.2 million deficit for 2028, county CFO Mark Lane earned my nickname: the “Darth Vader of budgets.”

What’s driving the “doom” forecast?

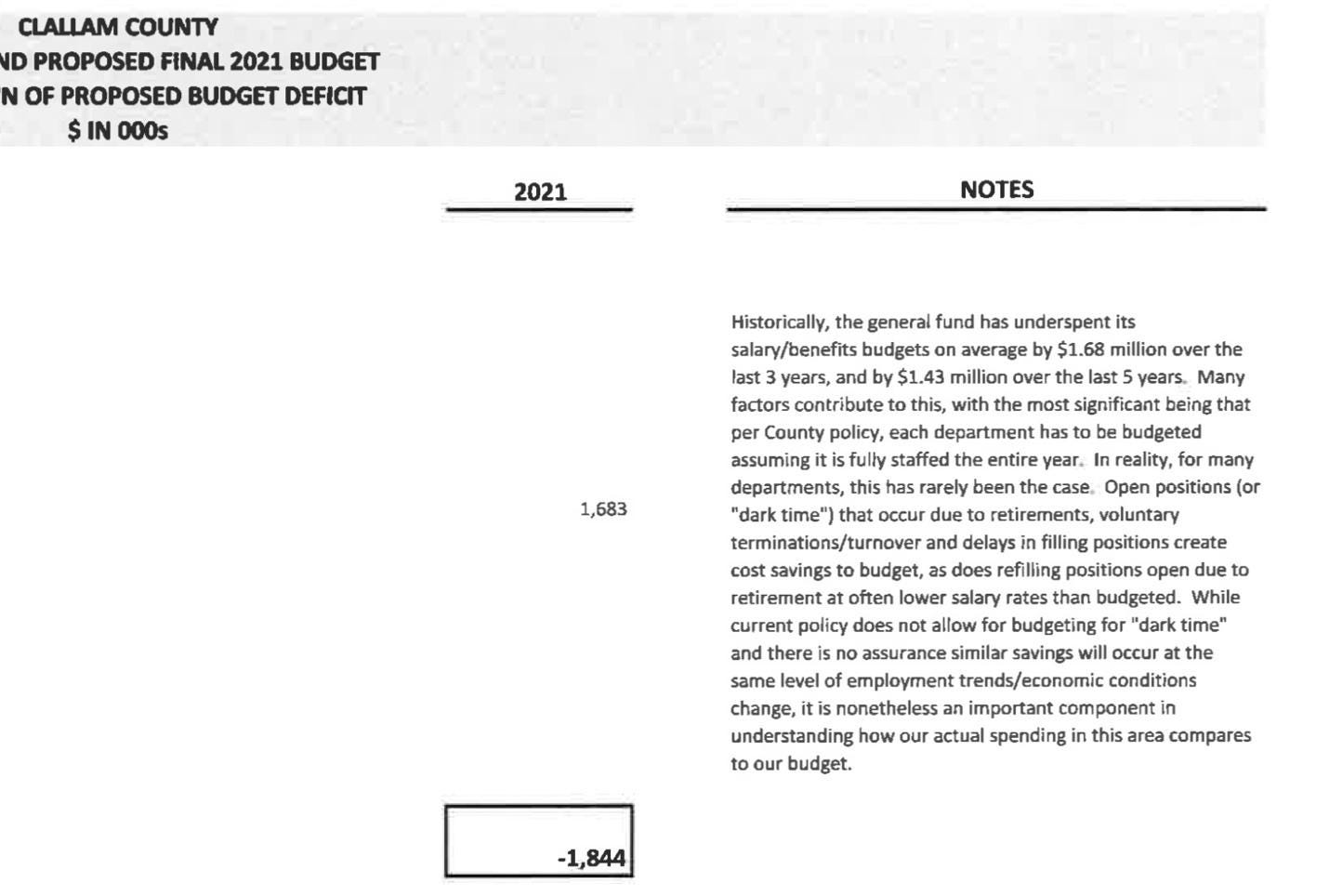

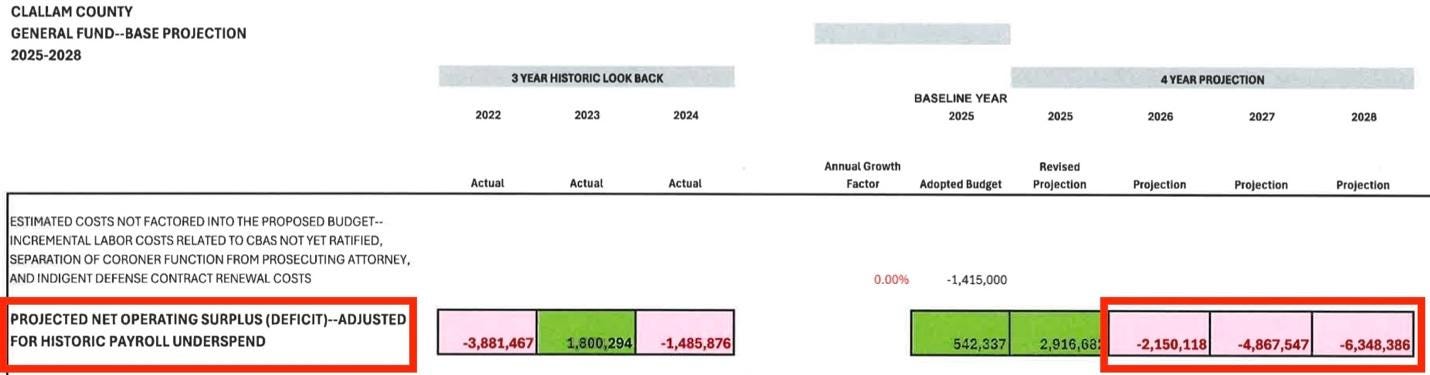

$1.8M in “underspend” — the county crafts its budget as if every department is fully staffed all year, which never happens. Adjusting for this alone drops the 2028 deficit to $6.3M.

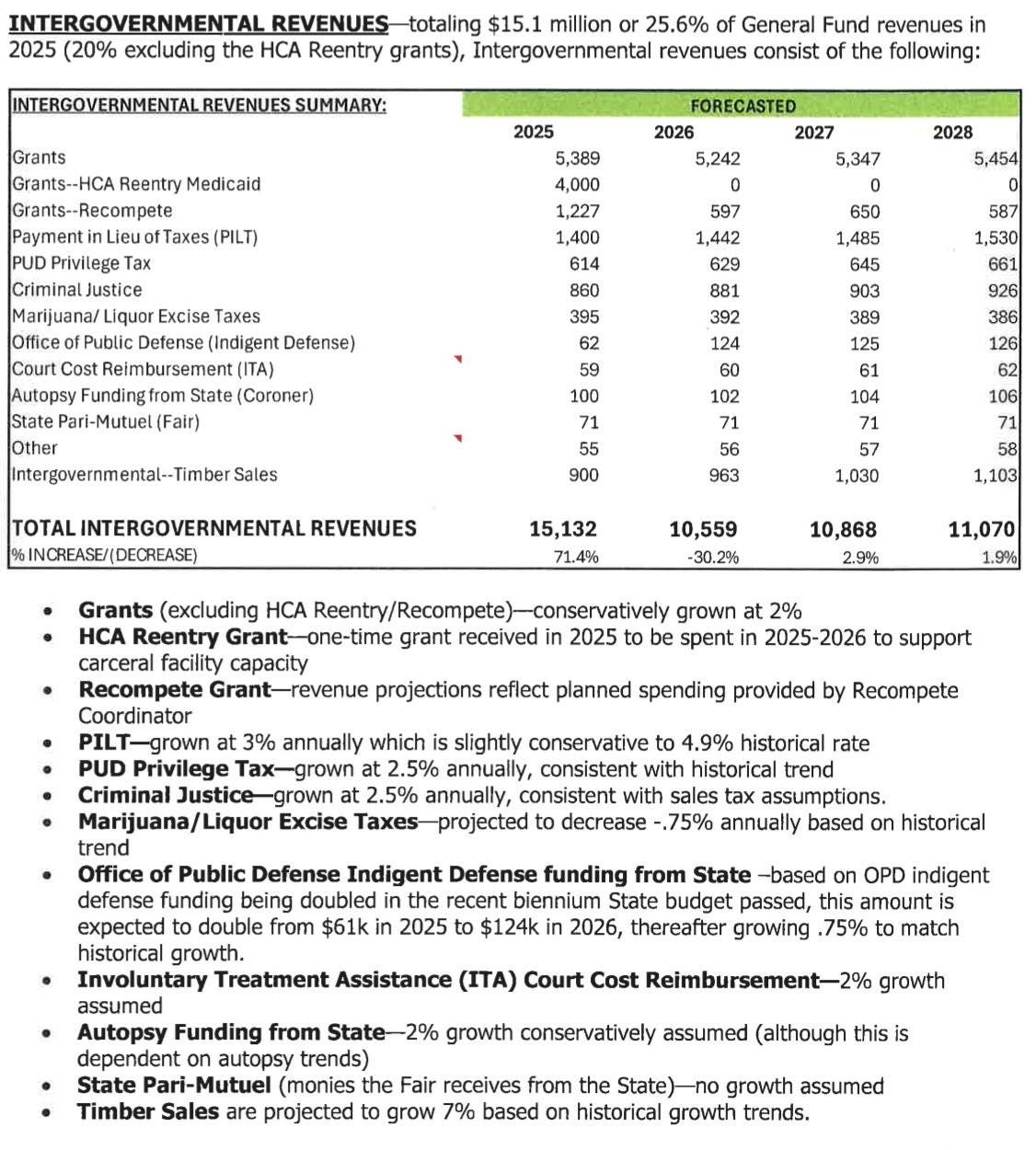

Revenue dip — entirely explained by a one-time $4 million HCA Reentry Medicaid grant (2025), a declining Recompete grant, and the assumption of lower interest income. All other revenues rise steadily through 2028.

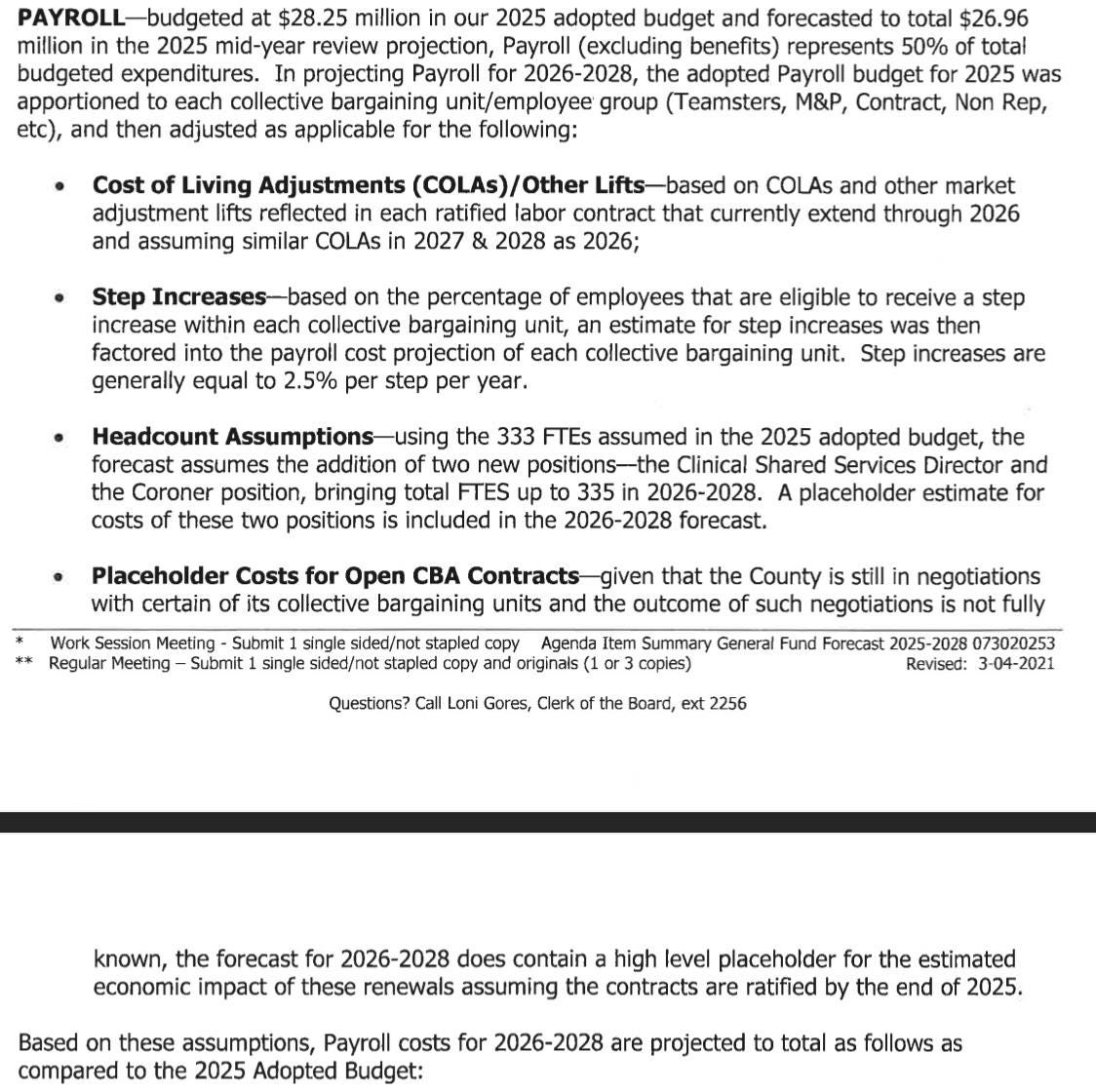

Skyrocketing Expenses — payroll/benefits (+$6M, +15%), insurance/workman’s comp (+$1.6M, +73%), and supplies (+$350K, +22.5%).

NOTE: expense increases are calculated from 2025 through 2028. Payroll/benefits accounts for “underspend”. More details on “underspend”, Intergovernmental Revenues, and Payroll are displayed below.

The County’s fatal financial forecasts should be the starting point for salary and insurance negotiations. Every expense deserves rigorous scrutiny before officials reach for the taxpayer’s wallet again.

Step 3: Extreme Anchor - Prepare the Counterparty for a Painful Loss

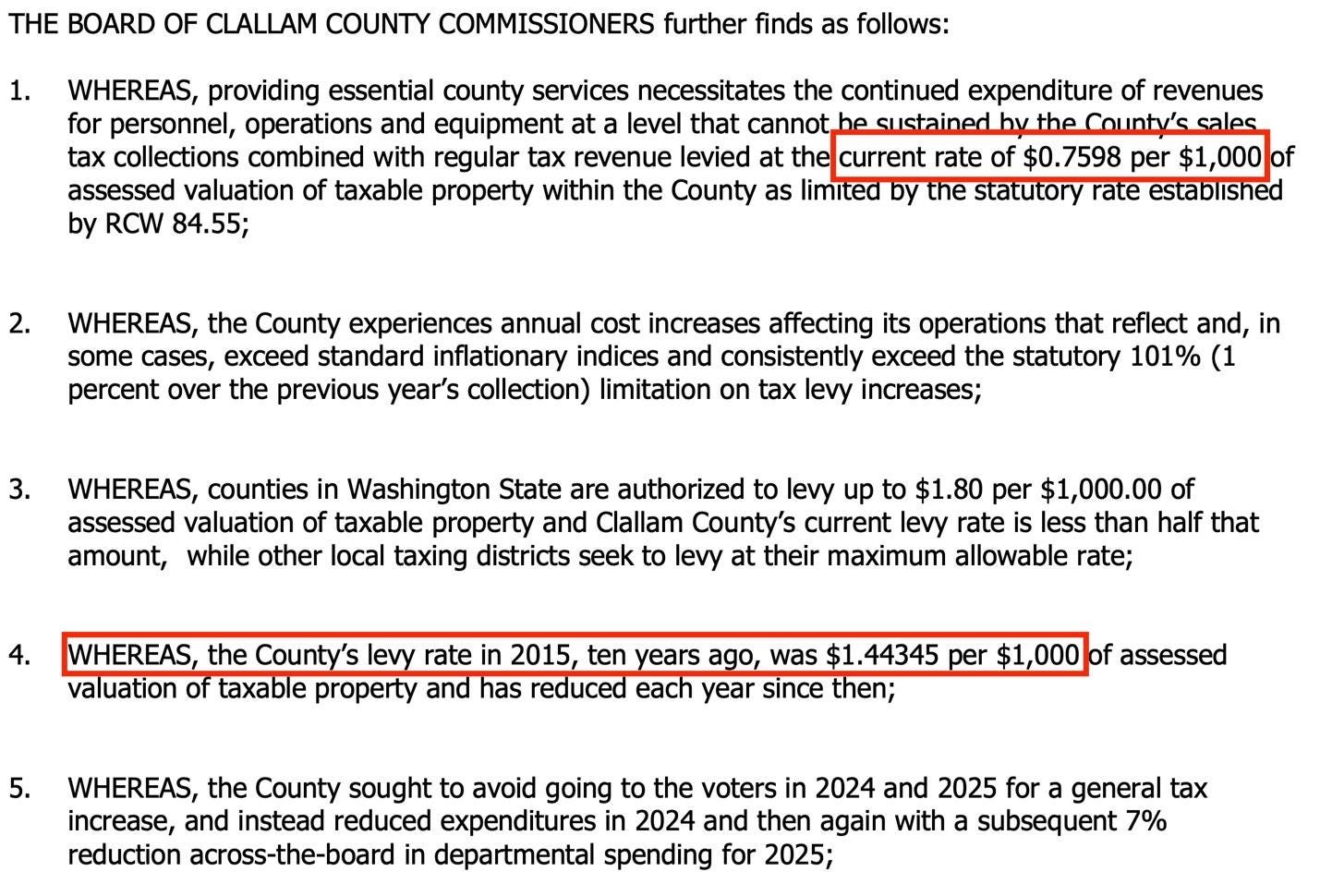

Before the levy hearing, commissioners proposed raising the levy rate from $0.7598 to $1.05 per $1,000 in value — plus annual CPI increases — eliminating the 1% growth cap until 2031. That’s a big ask, designed to make anything less feel reasonable.

Step 4: Present a “Fair” Solution

After priming voters for pain, the softer offer arrives.

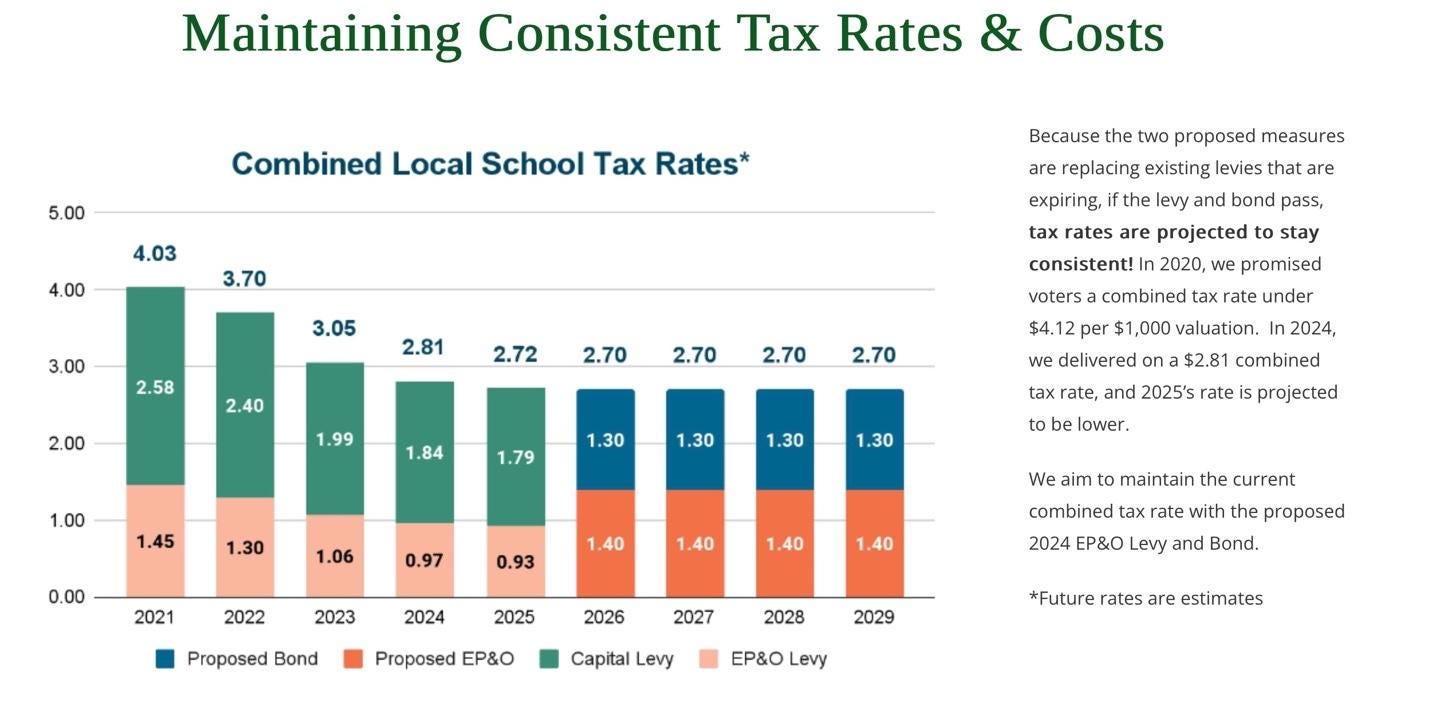

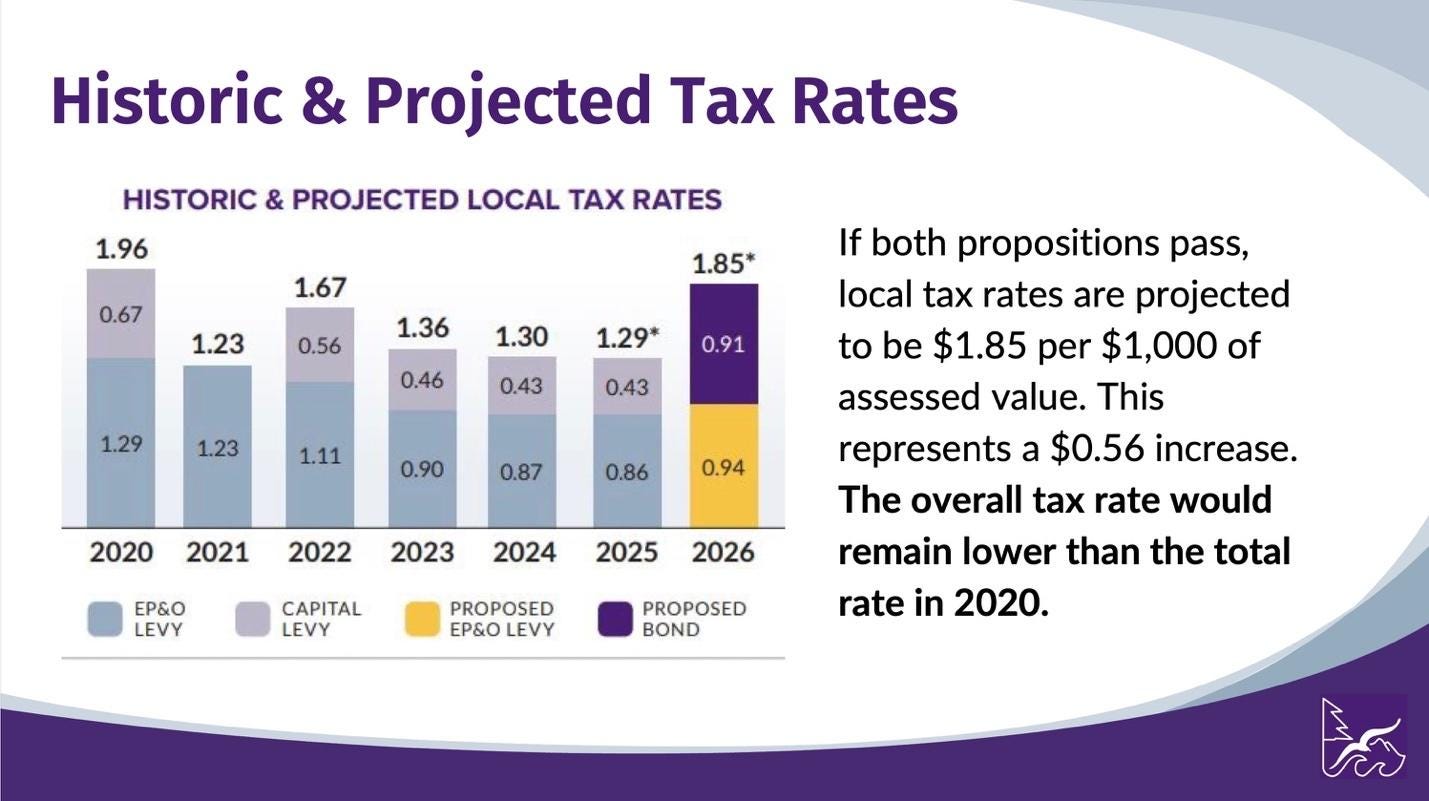

Levy campaigns often highlight that rates will stay at or below historical levels — a misleading comfort. The Port Angeles School District’s 2024 levy and bond proposal stated, “If the levy and bond pass, tax rates are projected to stay consistent!” Sequim School District's levy marketing made similar claims: “The overall tax rate would remain lower than the total rate in 2020.”

Rates may fall, but total tax collections and individual burden rarely do. Olympic Medical Center’s recent levy presentation clarified, “If passed, the rate may decrease over time as property values fluctuate, but the estimated levy amount of $12 million annually will remain until an adjustment is approved.”

The county is gearing up to sell us on the “rate”.

At the hearing, all three commissioners offered a “compromise”: $0.95 without CPI increases, keeping the 1% cap. I caught myself feeling relieved — as if they’d given us a gift. Then I wondered: was that always the plan?

Step 5: Never Take “No” For an Answer

When tax hikes fail, leaders rarely accept defeat. Instead, they repackage and reintroduce them until they pass. Fire District 2’s Proposition 1 failed in August 2024 but passed that November.

The Bottom Line

This strategy isn’t unique to Clallam County — they’re standard tactics in politics, business, and even personal relationships. The key is recognizing when you’re being sold.

What can you do?

Spot the tactics and vote accordingly

Show up. The Clallam Conservation District’s proposed $5/parcel fee will be decided by the commissioners. Attend the hearing. Provide public comment.

Ask commissioners what they’ve done lately to cut costs or raise revenue without raising taxes.

When you know the playbook, you’re harder to fool — and harder to convince to tax yourself.

Jacob Seegers is a husband, father, and Ohio State MBA graduate living in paradise - Clallam County, WA.

Last Sunday, readers were asked if taxpayer-funded homeless housing should include luxury amenities like dishwashers and rooftop terraces. Of 327 votes:

0% said, “Yes, dignity matters”

98% said, “No, keep it basic”

2% said, “Depends on the need”

Last day for CC Watchdog at the fair

Swing by today to say hello, grab some free stickers, share a tip, and talk about the stories legacy media won’t touch. Booth #60 is behind the carnival near the west entrance and open from 9 AM to 7 PM today.